The magic coin is 33 and 22 - missed today. I nailed it though simply by noting that the market was ready to bounce. And bounce it did - albeit very, very small rewards.

Notice that the plot line wasn't because the dollar mysteriously strengthened or oil dropped a lot or retail sales improved or anything else - in fact the Fed said that interest rate cuts were unlikely (bet me). The market went up because there was something to buy - it really is that simple.

I did nothing today because it was a gorgeous day here in Maryland. I went and played golf instead. I'm going on vacation for the rest of the week - so if the market goes down tomorrow - so what and if it goes back up the next day - so what - I don't intend to do any trading until next Monday at the earliest.

I also won't be posting after this one until Friday at the earliest and probably not until this weekend.

Anyway the up/down ratio returned to neutral as did the 20 day new highs at 275 and the 20 day new lows at 419. The three sisters all finished with doji as did IWM, the ugly stepsister. The proxy for the stock market of the 22nd century printed a strong white candle in the last hour. All of this put together probably means nobody knows nothing which, of course, is rule 1.

The magic coin calls tomorrow ... tails - bear coming - who cares. See you all this weekend.

Tuesday, November 28, 2006

"Oil and Dollar Woes

brought low the stock market on Monday November 27, 2006. A low dollar and increasing oil prices blah blah blah".

The Standard and Poors 500 Index declined 1% yesterday.

Those who read this BLOG regularly (thanks Mom) should know by now that the only thing that moves the market up are things to buy and the only thing that moves the market down are things to sell. Lately, like for the last two weeks or so there really hasn't been a whole lot to buy (hence the crazy mad buying spree in PNTR last Friday) but there has been a whole lot of things to sell. And yesterday was just a great day to sell.

Now here's what I would like you to think about. In 2005 the day after Thanksgiving was a low volume day. It took three days the next week but the market declined 1% off the price on the day after Thanksgiving. The next day it rebound and hasn't stopped yet.

But in 2004 was there a 1% decline? Same scenario but no just a small decline and then a rebound from that.

How about 2003? Same scenario again but no decline at all just up up up. But this was an aberration.

Because in 2002 there was a 2 day decline by 1% with a rebound after that and in 2001 there was a 3 day decline by 1% with a 2% rebound (in the midst of a bear market) the very next day.

If the shorty's out there are licking their chops and thinking about amazing wealth leading to maybe a Ford Focus under the tree this year - watch your step.

The Standard and Poors 500 Index declined 1% yesterday.

Those who read this BLOG regularly (thanks Mom) should know by now that the only thing that moves the market up are things to buy and the only thing that moves the market down are things to sell. Lately, like for the last two weeks or so there really hasn't been a whole lot to buy (hence the crazy mad buying spree in PNTR last Friday) but there has been a whole lot of things to sell. And yesterday was just a great day to sell.

Now here's what I would like you to think about. In 2005 the day after Thanksgiving was a low volume day. It took three days the next week but the market declined 1% off the price on the day after Thanksgiving. The next day it rebound and hasn't stopped yet.

But in 2004 was there a 1% decline? Same scenario but no just a small decline and then a rebound from that.

How about 2003? Same scenario again but no decline at all just up up up. But this was an aberration.

Because in 2002 there was a 2 day decline by 1% with a rebound after that and in 2001 there was a 3 day decline by 1% with a 2% rebound (in the midst of a bear market) the very next day.

If the shorty's out there are licking their chops and thinking about amazing wealth leading to maybe a Ford Focus under the tree this year - watch your step.

Labels:

Market decline,

market rebound,

shorting stock

Monday, November 27, 2006

Monday Wraps a Big One

Wow! Finally a 1% and then some decline in the S&P500. This is goodness for those of us who specialize in the long end of the stock market. But because I'm an excellent trader I actually made money today on the long side. I played Dollar General (DG) this morning and took an $80 and change loss on it after about an hour and a half. Later in the afternoon I saw the unmistakable signs (again) of a bottom and played once more - this time with more success. Both buys were off what appeared to be a dummy spot. The problem with the first one was that it followed a low volume candle and that made it a low probability trade. But the second one was following a high volume candle which raised its success probability appreciably. Also after the second dummy spot there was a gap up and I took the trade on that formation.

So you see even in a market as relentlessly sold off as today's was - if you pay attention you can make money long. Or, even in a market as relentlessly sold off as today's was - if you had gone short DG at the second time I went long you would have lost money. You have to be careful.

Are we now going to see many days of down - I don't think so. The market in general needed a good shake out and today it got it.

The up/down ratio sits at 18%(!), new 20 day high printed 156 (!) and new 20 day lows printed 607 (!). The VIX is now 15% above (!) its 10 day moving average and the three sisters, the ugly stepsister and the proxy for the stock market of the 22nd century - Goldman Sachs (GS) all threw off red candles in the last hour. How beautiful is all of this when put together in this manner? Boomer tomorrow - maybe.

The magic coin loses another and goes to 33 and 21 - not so good. For tomorrow it sees a bear. Dumb coin.

You better watch out, better not shout - Santa Claus is coming to town.

So you see even in a market as relentlessly sold off as today's was - if you pay attention you can make money long. Or, even in a market as relentlessly sold off as today's was - if you had gone short DG at the second time I went long you would have lost money. You have to be careful.

Are we now going to see many days of down - I don't think so. The market in general needed a good shake out and today it got it.

The up/down ratio sits at 18%(!), new 20 day high printed 156 (!) and new 20 day lows printed 607 (!). The VIX is now 15% above (!) its 10 day moving average and the three sisters, the ugly stepsister and the proxy for the stock market of the 22nd century - Goldman Sachs (GS) all threw off red candles in the last hour. How beautiful is all of this when put together in this manner? Boomer tomorrow - maybe.

The magic coin loses another and goes to 33 and 21 - not so good. For tomorrow it sees a bear. Dumb coin.

You better watch out, better not shout - Santa Claus is coming to town.

Sunday, November 26, 2006

Now For Something A Little Different

Well not really – we’re still going to talk about markets and trading. But as promised here is a look at what happens on gap ups over the next day or so. And there were some interesting findings. I looked at stocks in my favorite range of 20 – 35 dollars and I built a filter that simply said:

Show stocks where close is between 20 and 35 and;

the 90 day average volume is more than 500000 shares; and

the close is less than the EMA 90 (from the other day’s post); and

the close is greater than the open; and the open was greater than the close of 1 day ago.

Then I began testing it to determine what the best set of conditions would be. What I found was by using a stop loss of 10%, a 2 day maximum holding period, buying no more than 2 stocks in any one day and holding no more than 4 stocks in the portfolio at any one time I could achieve optimum results.

I had no exit based on a profit percentage I just held the stocks for 2 days and sold them at the close on the second day. By doing this I could take a 100K trading account and yield 51K profit in 77 days.

Nobody can do that of course but that was the best yield I could attain in my back testing. What this suggests is that you if you use a short term holding period with a few stocks that meet the above filter requirements you will probably make some money. Each day the 2 stocks are to be selected based on the 2 highest average volume stocks found in that days filter output. By limiting the portfolio to no more than 4 stocks at a time I optimized the number of shares purchased simply by using 25% of the total available portfolio up to the amount of cash available.

I don’t know how many different runs I made but they were substantial. And my findings are interesting in their own light. For example if I set the system to hold 10 days maximum under the same buying and portfolio conditions the yield was only 23K. That suggests that stocks that gap up have a short half-life and you should take advantage of them as quickly as you can. Fortunately there are a lot of gap ups every day.

Another finding that should be obvious is the fact that the more stocks you hold the fewer stocks you can buy given a finite trading account. This means that if you back test be sure to set your starting cash position to something that is reasonable. I always think that diversification is a word brokers use to get more commissions. Now if you diversify by hedging one investment against another – well that’s different. But if you diversify by holding 40 stocks in a portfolio – that’s stupid.

Needless to say you can not roll your funds over as fluidly as you can in a back test environment – there is no three-day hi-jack period where the brokerage makes money from your money and you do not. Nor do you pay commissions in the back test world.

And of course you always get the optimal open and closing prices but once again the dollar value is only an indicator that suggests the optimization of the conditions.

As usual this is not an invitation to speculate in the wonderful world of high finance because as most of my reader (hi Mom) knows - it isn't a place for nice people to be found.

Show stocks where close is between 20 and 35 and;

the 90 day average volume is more than 500000 shares; and

the close is less than the EMA 90 (from the other day’s post); and

the close is greater than the open; and the open was greater than the close of 1 day ago.

Then I began testing it to determine what the best set of conditions would be. What I found was by using a stop loss of 10%, a 2 day maximum holding period, buying no more than 2 stocks in any one day and holding no more than 4 stocks in the portfolio at any one time I could achieve optimum results.

I had no exit based on a profit percentage I just held the stocks for 2 days and sold them at the close on the second day. By doing this I could take a 100K trading account and yield 51K profit in 77 days.

Nobody can do that of course but that was the best yield I could attain in my back testing. What this suggests is that you if you use a short term holding period with a few stocks that meet the above filter requirements you will probably make some money. Each day the 2 stocks are to be selected based on the 2 highest average volume stocks found in that days filter output. By limiting the portfolio to no more than 4 stocks at a time I optimized the number of shares purchased simply by using 25% of the total available portfolio up to the amount of cash available.

I don’t know how many different runs I made but they were substantial. And my findings are interesting in their own light. For example if I set the system to hold 10 days maximum under the same buying and portfolio conditions the yield was only 23K. That suggests that stocks that gap up have a short half-life and you should take advantage of them as quickly as you can. Fortunately there are a lot of gap ups every day.

Another finding that should be obvious is the fact that the more stocks you hold the fewer stocks you can buy given a finite trading account. This means that if you back test be sure to set your starting cash position to something that is reasonable. I always think that diversification is a word brokers use to get more commissions. Now if you diversify by hedging one investment against another – well that’s different. But if you diversify by holding 40 stocks in a portfolio – that’s stupid.

Needless to say you can not roll your funds over as fluidly as you can in a back test environment – there is no three-day hi-jack period where the brokerage makes money from your money and you do not. Nor do you pay commissions in the back test world.

And of course you always get the optimal open and closing prices but once again the dollar value is only an indicator that suggests the optimization of the conditions.

As usual this is not an invitation to speculate in the wonderful world of high finance because as most of my reader (hi Mom) knows - it isn't a place for nice people to be found.

Saturday, November 25, 2006

Blind Squirrel Finds Acorn

Sometimes you just stumble across things. There's no "eureka" moment - it just happens - it happens. Earlier I mentioned that I was working on an idea regarding an exponential moving average crossing a simple moving average. I thought that might make for a nice swing trade idea. It didn't work.

Since then I read something that Jim Cramer said the other day regarding speculative stocks. He said if you speculate you should remain between $2 and $10 as that was where you would find the best bets. I'm paraphrasing - Jim always calls it "investing" but we know what he really means don't we gang - wink-wink-nudge-nudge (second time today).

Anyway I tried "EMA 21 crosses MA 20" filter for stocks in the $2 to $10 range and I started getting some good hits. I added a volume requirement (90 day average .5 million shares) to weed out the weak sisters and then added the fact that they should be below the EMA 90 at least 4 days ago (based on swing trading findings from earlier). After looking at the results of the scans over several days in the past (another stockfetcher capability) I dropped the value requirement from $10 to $7 and began to backtest.

I set up a simple enough test using several variations. First - stop loss, second - number of days held, third - number of stocks bought daily, and fourth number of stocks held in the portfolio.

After many runs I settled on stop loss = 10%, no profit exit, sell after 4 days (or stop loss hit), buy only 1 stock per day and never have more than 4 in the portfolio at any given time. The no profit exit option was selected because I decided that I didn't want to cut off my profit potential since I was only holding 4 days.

Result of the test - in 77 days out of 77 stocks purchased and held 4 days only 7 were stopped out - the rest were sold after 4 days or on the last day of the test. Bottom line - using a $100K account - the filter racked up a whopping plus $43727. The maximum loss was $3417.00 and that occurred early in the process.

Now I'm not saying that you can make this kind of money from such a simple system nor am I saying that I can but here's the bottom line. I changed the dollar requirement from 2 to 7 to 20 to 70 with a commensurate increase in the volume requirement and the return was $560.00. So given slippage and the need to buy several thousand shares of cheap stocks as well as find a buyer for same 4 days later you probably can cut the 43K in half and make it a more reasonable 20K. But you don't have to cut that 560 bucks in half - you will probably get that whole amount.

Point being a simple filter can return remarkable results if the venue is correct. Something like this can work on cheap stocks because you only need a dime or a quarter to make some money off them whereas on the more expensive stocks you need a lot bigger move.

Anyway past performance is never a good judge of future performance and keep in mind that the test period selected was also the period of recent market gains as a whole.

I'm going to be looking at the day(s) after a spectacular gap up and rise in a future post. Stay tuned.

Since then I read something that Jim Cramer said the other day regarding speculative stocks. He said if you speculate you should remain between $2 and $10 as that was where you would find the best bets. I'm paraphrasing - Jim always calls it "investing" but we know what he really means don't we gang - wink-wink-nudge-nudge (second time today).

Anyway I tried "EMA 21 crosses MA 20" filter for stocks in the $2 to $10 range and I started getting some good hits. I added a volume requirement (90 day average .5 million shares) to weed out the weak sisters and then added the fact that they should be below the EMA 90 at least 4 days ago (based on swing trading findings from earlier). After looking at the results of the scans over several days in the past (another stockfetcher capability) I dropped the value requirement from $10 to $7 and began to backtest.

I set up a simple enough test using several variations. First - stop loss, second - number of days held, third - number of stocks bought daily, and fourth number of stocks held in the portfolio.

After many runs I settled on stop loss = 10%, no profit exit, sell after 4 days (or stop loss hit), buy only 1 stock per day and never have more than 4 in the portfolio at any given time. The no profit exit option was selected because I decided that I didn't want to cut off my profit potential since I was only holding 4 days.

Result of the test - in 77 days out of 77 stocks purchased and held 4 days only 7 were stopped out - the rest were sold after 4 days or on the last day of the test. Bottom line - using a $100K account - the filter racked up a whopping plus $43727. The maximum loss was $3417.00 and that occurred early in the process.

Now I'm not saying that you can make this kind of money from such a simple system nor am I saying that I can but here's the bottom line. I changed the dollar requirement from 2 to 7 to 20 to 70 with a commensurate increase in the volume requirement and the return was $560.00. So given slippage and the need to buy several thousand shares of cheap stocks as well as find a buyer for same 4 days later you probably can cut the 43K in half and make it a more reasonable 20K. But you don't have to cut that 560 bucks in half - you will probably get that whole amount.

Point being a simple filter can return remarkable results if the venue is correct. Something like this can work on cheap stocks because you only need a dime or a quarter to make some money off them whereas on the more expensive stocks you need a lot bigger move.

Anyway past performance is never a good judge of future performance and keep in mind that the test period selected was also the period of recent market gains as a whole.

I'm going to be looking at the day(s) after a spectacular gap up and rise in a future post. Stay tuned.

Here Comes Santa Claus

Although there is a lot of talk about a Santa Claus rally all I see are the indices rolling over and pointing down. This is expected from the INDU (DIA) of course - it has had a great run and needs a rest, but the SPY and IWM are also rolling. Where they go, generally, NASDAQ will also go.

I've been expecting an overall decline in the market for some time now (who hasn't) and wouldn't be surprised to see it slide down through December then start getting active again in January. If the last seven days are a clue there is absolutely no volatility left in this old beast at all. The VIX is signalling that the market ahead should remain largely listless. The other day (Friday) was the first sign of life the VIX has shown in a while. Of course it could go right back to sleep but I think it will start increasing here as a signal that some volatility will be coming back into the market come January.

We'll see.

Am I Playing Enough?

Some traders seem to believe that the key to fortune is more trades - they can't get enough trades going. That might be a wrong idea.

Using my filtering website - stockfetcher.com - I set up a test that output results of different levels of trading activity. I used 1, 2, 4 and 25 a day maximum with a 5% profit exit and 10% stop loss. I still held only 4 days maximum. Here are the results of a 77 day trading period:

Trades Per Day/Portfolio - Amount Profit

1/4 - $9746

2/8 - $8933

4/16 - $6227

25/100 - $629

OK - same trading account - same trading period - same filter being used to select candidates. The only difference being the number of stocks that can be traded and the number of stocks in the portfolio.

Because the raw amount is the total profit at the end of the trading period it is obvious that 1 or 2 trades per day will yield the best results.

Now remember that there are many different ways to slice the number of trades you are in at any one time but this seems to be saying that having fewer is better.

Using my filtering website - stockfetcher.com - I set up a test that output results of different levels of trading activity. I used 1, 2, 4 and 25 a day maximum with a 5% profit exit and 10% stop loss. I still held only 4 days maximum. Here are the results of a 77 day trading period:

Trades Per Day/Portfolio - Amount Profit

1/4 - $9746

2/8 - $8933

4/16 - $6227

25/100 - $629

OK - same trading account - same trading period - same filter being used to select candidates. The only difference being the number of stocks that can be traded and the number of stocks in the portfolio.

Because the raw amount is the total profit at the end of the trading period it is obvious that 1 or 2 trades per day will yield the best results.

Now remember that there are many different ways to slice the number of trades you are in at any one time but this seems to be saying that having fewer is better.

Are You Holding It Long Enough?

How many times have I read on one BLOG or another - "man - I sold that one too early" - for that matter how many times have I said that? At least once that I remember - - (actually more times than I care to remember).

Well let me tell you this about that - for every time you hear or read that statement there are probably 10 more times when someone says - "held it too long - lost all my gains."

I decided to test a premise or two regarding this idea of "holding too long/not long enough" and came up with some amazing results. The filtering software I use - stockfetcher.com - has the capability to do moderately sophisticated backtesting. One of the things it allows is for you to set-up a variety of exit criteria. I thought I'd take advantage of that capability.

I took a very simple filter that I am working on - one moving average crossing another that throws off a profit over time. (Actually it is an EMA crossing a simple moving average and it seems to have promise - if it proves out I'll publish it - I promise.) What I did was set up a simple exit criteria - a stop loss set at 10% coupled with three levels of profit for exit - 5%, 10% or 15%. In other words if I hit a profit at one the pre-selected levels I would close the trade. I kept my normal set-up regarding number of plays per day (1) and number of stocks in the portfolio (4) and number of days to hold maximum at 4.

Here are the results: 5% profit = $9746, 10% profit = $9479 and 15% profit = $4546

Amazing - by asking for a lower profit performance we actually achieved twice the amount of profits.

Ok a couple of things. First - the exact same set of stocks were selected and played in all three tests. Second - only closing values were used. In other words if any stock hit 15% intraday and then traded below that at the close - it was held another day and it might not have reached 15% again. Third all holdings regardless of their profit/loss status were sold on the fourth day of holding or on the last day of the test.

Bottom line of that - if a human were watching this they might have improved on the numbers a bit. But because the results at 5% are twice as good as 15% and the 10% result is nearly as good as the 5% I wouldn't expect great improvements - some maybe but not great ones and - by keeping the entire thing mechanical you can't second guess.

So it appears if you lower your profit target there is a possibility that you will increase your profitability. And that is always nice - isn't it?

Well let me tell you this about that - for every time you hear or read that statement there are probably 10 more times when someone says - "held it too long - lost all my gains."

I decided to test a premise or two regarding this idea of "holding too long/not long enough" and came up with some amazing results. The filtering software I use - stockfetcher.com - has the capability to do moderately sophisticated backtesting. One of the things it allows is for you to set-up a variety of exit criteria. I thought I'd take advantage of that capability.

I took a very simple filter that I am working on - one moving average crossing another that throws off a profit over time. (Actually it is an EMA crossing a simple moving average and it seems to have promise - if it proves out I'll publish it - I promise.) What I did was set up a simple exit criteria - a stop loss set at 10% coupled with three levels of profit for exit - 5%, 10% or 15%. In other words if I hit a profit at one the pre-selected levels I would close the trade. I kept my normal set-up regarding number of plays per day (1) and number of stocks in the portfolio (4) and number of days to hold maximum at 4.

Here are the results: 5% profit = $9746, 10% profit = $9479 and 15% profit = $4546

Amazing - by asking for a lower profit performance we actually achieved twice the amount of profits.

Ok a couple of things. First - the exact same set of stocks were selected and played in all three tests. Second - only closing values were used. In other words if any stock hit 15% intraday and then traded below that at the close - it was held another day and it might not have reached 15% again. Third all holdings regardless of their profit/loss status were sold on the fourth day of holding or on the last day of the test.

Bottom line of that - if a human were watching this they might have improved on the numbers a bit. But because the results at 5% are twice as good as 15% and the 10% result is nearly as good as the 5% I wouldn't expect great improvements - some maybe but not great ones and - by keeping the entire thing mechanical you can't second guess.

So it appears if you lower your profit target there is a possibility that you will increase your profitability. And that is always nice - isn't it?

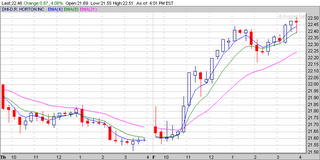

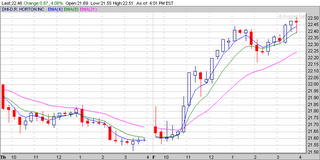

PNTR - What A Ride

No I didn't play this piece of crap (POC) - I know of people who did - but for me - well let me say that first - it was, up until Wednesday, a low volume, never-traded stock. You want proof? Take a look -

On Monday and Tuesday it was traded twice - once each day for 200 shares each - On Wednesday it started heating up as a result of earnings. Earnings were - 14 cents per share vs a year earlier where they were -14 cents per share.

Second, for what it is worth, it is an Israeli company that specializes in - road-side assistance. Oh yes, oh yes my kind of company - let me have a bigger piece of pie please - please. - But more importantly - it is below my dollar value cutoff - I try not to play anything below 20 and everytime that I do I always renew my vow to never again play anything below 20. Hope you got that point.

So on a day where there was no action (Friday), someone notices that this little POC is catching a bid and - boom city. All the way to 25 before it collapses.

Interesting enough - the little guy actually set up quite nicely - a standard kiss the EMA 4 and take off kind of set up. See how the stock goes up then slides sideways to the EMA 4? You've seen that set up before on this site.

So had I noticed it would I have played it? Not even if I was playing with your money Bunky - this was a disaster waiting to happen - somebody bought this stock up at 25 points and - boom! Actually a lot of somebodies bought this thing all the way from 15.16 (where it ended) to 25 where it topped and I bet some of them are still sorry today.

That large red blue volume line at 11:30 followed by an even larger red volume line at 12:00 suggests that 11:30 was a "blow-off top" - you've seen those before - on this site.

Unfortunately it didn't collapse all at once - there were still a whole lot of buyers in the game between 25 and 15.16 where it eventually stopped to rest. I'm sure there were a lot of wannabe shorties out there but with the float on this one being about 6 shares - lots of luck - thank God. My heartfelt (actually I'm laughing so hard snot is pouring out of my nose as I write this) but let me say this - everytime a share is sold someone else buys a share. So someone is stuck with about a million point six shares of this POC and I really really hope it isn't anyone I know - and if it is - no I don't want to go halves with you on a really great investment.

Ok all kidding aside I hope that you were one of the lucky ones who bought on the left side of this mountain and sold on the right side. If you weren't and you are still holding - welcome to the wacky world of "investment" - you just got yourself one Bunky.

I can hardly wait until Monday to see if there will be yet another chapter in the saga of PNTR - road side assistance par excellence.

On Monday and Tuesday it was traded twice - once each day for 200 shares each - On Wednesday it started heating up as a result of earnings. Earnings were - 14 cents per share vs a year earlier where they were -14 cents per share.

Second, for what it is worth, it is an Israeli company that specializes in - road-side assistance. Oh yes, oh yes my kind of company - let me have a bigger piece of pie please - please. - But more importantly - it is below my dollar value cutoff - I try not to play anything below 20 and everytime that I do I always renew my vow to never again play anything below 20. Hope you got that point.

So on a day where there was no action (Friday), someone notices that this little POC is catching a bid and - boom city. All the way to 25 before it collapses.

Interesting enough - the little guy actually set up quite nicely - a standard kiss the EMA 4 and take off kind of set up. See how the stock goes up then slides sideways to the EMA 4? You've seen that set up before on this site.

So had I noticed it would I have played it? Not even if I was playing with your money Bunky - this was a disaster waiting to happen - somebody bought this stock up at 25 points and - boom! Actually a lot of somebodies bought this thing all the way from 15.16 (where it ended) to 25 where it topped and I bet some of them are still sorry today.

That large red blue volume line at 11:30 followed by an even larger red volume line at 12:00 suggests that 11:30 was a "blow-off top" - you've seen those before - on this site.

Unfortunately it didn't collapse all at once - there were still a whole lot of buyers in the game between 25 and 15.16 where it eventually stopped to rest. I'm sure there were a lot of wannabe shorties out there but with the float on this one being about 6 shares - lots of luck - thank God. My heartfelt (actually I'm laughing so hard snot is pouring out of my nose as I write this) but let me say this - everytime a share is sold someone else buys a share. So someone is stuck with about a million point six shares of this POC and I really really hope it isn't anyone I know - and if it is - no I don't want to go halves with you on a really great investment.

Ok all kidding aside I hope that you were one of the lucky ones who bought on the left side of this mountain and sold on the right side. If you weren't and you are still holding - welcome to the wacky world of "investment" - you just got yourself one Bunky.

I can hardly wait until Monday to see if there will be yet another chapter in the saga of PNTR - road side assistance par excellence.

Friday, November 24, 2006

Friday Wraps Up Early

Early day - we didn't do much - added a bit to our GM trade from the other day and began a swing trade in AMD - other than that nothing too exciting.

This was a strange day - started out down then went up then went down again. Goldie (GS) kind of set the tone for the whole day - gapped down nearly $2 at the start, went down from there for the first 15 minutes losing another dollar then turned around an went up for the next couple of hours until about 11:15 when it reversed again finally finishing the day off 19 cents. All three sisters, the ugly stepsister and GS, the proxy for the stock market of the 22nd century finished the last hour in the red - which, believe it or not is a good sign. The VIX pulled way back into the neutral zone and the up/down ratio prints 40%. The new 20 day highs pulled back again but remain above 600 at 672 and the new 20 day lows also pulled back to 135. Believe it or not but all these things together suggest not just an up day on Monday but a strong up day to boot.

The magic coin is 33 and 20 having missed today and for Monday says ... heads - bull market - well we think so too.

This was a strange day - started out down then went up then went down again. Goldie (GS) kind of set the tone for the whole day - gapped down nearly $2 at the start, went down from there for the first 15 minutes losing another dollar then turned around an went up for the next couple of hours until about 11:15 when it reversed again finally finishing the day off 19 cents. All three sisters, the ugly stepsister and GS, the proxy for the stock market of the 22nd century finished the last hour in the red - which, believe it or not is a good sign. The VIX pulled way back into the neutral zone and the up/down ratio prints 40%. The new 20 day highs pulled back again but remain above 600 at 672 and the new 20 day lows also pulled back to 135. Believe it or not but all these things together suggest not just an up day on Monday but a strong up day to boot.

The magic coin is 33 and 20 having missed today and for Monday says ... heads - bull market - well we think so too.

Swing Trade - 4

In this one I combined the SMA 200 with the SMA 20 in several variations.

If the Close is:

< 200 > 20 27871

< 200 < 20 4308

> 200 > 20 19994

> 200 < 20 12393

Again this is for 1 trade a day, no more than 4 stocks in the portfolio at any one time, and the holding (swing) period is at least 1 day but no more than 4 days.

The filter requirements are exactly the same as those in Swing Trade - 3.

The obvious winner, again, is when the close is less than the 200 period moving average and less than the 20 day moving average.

If you do decide to use exponential moving averages you are probably going to be a little bit ahead of the average trader - by this I mean the exponential should get you into the trade before the other guy and that is a good thing. It will also get you out before him too and that, sometimes, is even a better thing.

None of these posts are recommendations - do your own due dilligence. Betting, uh, playing, uh, "investing" (wink wink nudge nudge) in the stock market is not as easy as it looks. Trust me - I've got the scars to prove it.

If the Close is:

< 200 > 20 27871

< 200 < 20 4308

> 200 > 20 19994

> 200 < 20 12393

Again this is for 1 trade a day, no more than 4 stocks in the portfolio at any one time, and the holding (swing) period is at least 1 day but no more than 4 days.

The filter requirements are exactly the same as those in Swing Trade - 3.

The obvious winner, again, is when the close is less than the 200 period moving average and less than the 20 day moving average.

If you do decide to use exponential moving averages you are probably going to be a little bit ahead of the average trader - by this I mean the exponential should get you into the trade before the other guy and that is a good thing. It will also get you out before him too and that, sometimes, is even a better thing.

None of these posts are recommendations - do your own due dilligence. Betting, uh, playing, uh, "investing" (wink wink nudge nudge) in the stock market is not as easy as it looks. Trust me - I've got the scars to prove it.

Swing Trade - 3

I combined the EMA 90 with the EMA 21 in several variations. As usual now the results are surprising.

If the Close is:

< 90 > 21 33627

< 90 < 21 8214

> 90 > 21 18888

> 90 < 21 18911

This is for 1 trade a day, no more than 4 stocks in the portfolio at any one time, and the hold (swing) period is at least 1 day but no more than 4 days.

I made one other change to the filter - I took out the requirement for close to be greater than the last close. In other words any stock that meets the moving average requirement and has the highest average volume for that day is the stock that is selected. It doesn't get any simpler than that.

Obviously the best of the four options is when high volume stocks close below the EMA 90 but above the EMA 21. The second best is when they are above the EMA 90 and above the EMA 21. This fits into the pattern suggested by swing trade-2 where the best options were for stocks closing above their EMA 21 and MA 20.

If the Close is:

< 90 > 21 33627

< 90 < 21 8214

> 90 > 21 18888

> 90 < 21 18911

This is for 1 trade a day, no more than 4 stocks in the portfolio at any one time, and the hold (swing) period is at least 1 day but no more than 4 days.

I made one other change to the filter - I took out the requirement for close to be greater than the last close. In other words any stock that meets the moving average requirement and has the highest average volume for that day is the stock that is selected. It doesn't get any simpler than that.

Obviously the best of the four options is when high volume stocks close below the EMA 90 but above the EMA 21. The second best is when they are above the EMA 90 and above the EMA 21. This fits into the pattern suggested by swing trade-2 where the best options were for stocks closing above their EMA 21 and MA 20.

Swing Trading - 2

As promised I looked at some shorter term averages and - wow - that's about all I can say - well I could say some other things but I'm trying to keep this family friendly - if you get my drift.

I used an EMA 21 and an MA 20 - at two different levels of severity - 5% and 8%. The backtesting script remained the same - here are the results -

< EMA 21 5% -144 8% -5721

> EMA 21 7883 855

< MA 20 804 -1067

> MA 20 10754 4676

What this is saying is that being above the short term average is a good thing and that being above the simple 20 period moving average is better than being above the exponential 21 period moving average. That, naturally, is totally different from the findings with the longer term averages.

Wow! Now I have to go and look and see what combining the long and short term averages will do for us. I can hardly wait.

I used an EMA 21 and an MA 20 - at two different levels of severity - 5% and 8%. The backtesting script remained the same - here are the results -

< EMA 21 5% -144 8% -5721

> EMA 21 7883 855

< MA 20 804 -1067

> MA 20 10754 4676

What this is saying is that being above the short term average is a good thing and that being above the simple 20 period moving average is better than being above the exponential 21 period moving average. That, naturally, is totally different from the findings with the longer term averages.

Wow! Now I have to go and look and see what combining the long and short term averages will do for us. I can hardly wait.

Swing Trading

True to the name of the site we have come up with a couple of new filters - this time for picking trades for swing trading. Simplicity is the key to the very best filters and these two are so simple even a caveman ... never mind that's been used already ---

The basic filter is stocks that close between 20 and 59 dollars and are +/-15% of their 90 day EMA where the most recent close finished greater than the previous days close.

Ok - in layman's terms I am trying to garner a list of stocks that are currently either 15% below their EMA 90 or 15% above their EMA 90. This was based on Dr. Brett Steenbarger's column today regarding the moving average and the fact that the SPX shows much better returns when it is below its 200 day moving average than when it is above. I just used an exponential moving average rather than a simple and individual stocks rather than an index.

I backtested the two filters against the same set of conditions most notably only one stock would be played a day (the highest 90 day average volume stock) and only 4 stocks would be held in the portfolio at a time. Using a 100K bankroll that meant that no more than 25K would be played on any given stock. I set my hold period to no more than 4 days or 10% loss or 15% gain or momentum greater than 2 whichever came first.

The envelope please - in both instances a 77 day period was used (ending on 11/22) which meant that 77 stocks were picked. Of the stocks that began greater than the EMA 90 the end result was a loss of 183 dollars. Of the stocks that began less than the EMA 90 the end result was a gain of 29831 dollars. Big difference.

Then, for fun, I switch the EMA to a simple moving average using 200 as the base. The end result this time for the less than 200 day moving average was 26484 dollars - a small difference. However, for the greater than 200 day moving average the result was 11632 dollars - which is a big difference.

But in both instances Dr. Brett's experiment is supported - you should have better returns with stocks starting from below a long term moving average than with those starting from above. That is a result of regression to the mean.

If I have the time over the weekend I'll try this with a couple of other moving averages - specifically the EMA 21 and the MA 20. Needless to say I could get really classy and start combining long and short term averages and if I don't get too confused I might try it.

I used Stockfetcher.com for my filtering and backtesting software. Different date ranges and exit settings will necessarily yield different results.

The basic filter is stocks that close between 20 and 59 dollars and are +/-15% of their 90 day EMA where the most recent close finished greater than the previous days close.

Ok - in layman's terms I am trying to garner a list of stocks that are currently either 15% below their EMA 90 or 15% above their EMA 90. This was based on Dr. Brett Steenbarger's column today regarding the moving average and the fact that the SPX shows much better returns when it is below its 200 day moving average than when it is above. I just used an exponential moving average rather than a simple and individual stocks rather than an index.

I backtested the two filters against the same set of conditions most notably only one stock would be played a day (the highest 90 day average volume stock) and only 4 stocks would be held in the portfolio at a time. Using a 100K bankroll that meant that no more than 25K would be played on any given stock. I set my hold period to no more than 4 days or 10% loss or 15% gain or momentum greater than 2 whichever came first.

The envelope please - in both instances a 77 day period was used (ending on 11/22) which meant that 77 stocks were picked. Of the stocks that began greater than the EMA 90 the end result was a loss of 183 dollars. Of the stocks that began less than the EMA 90 the end result was a gain of 29831 dollars. Big difference.

Then, for fun, I switch the EMA to a simple moving average using 200 as the base. The end result this time for the less than 200 day moving average was 26484 dollars - a small difference. However, for the greater than 200 day moving average the result was 11632 dollars - which is a big difference.

But in both instances Dr. Brett's experiment is supported - you should have better returns with stocks starting from below a long term moving average than with those starting from above. That is a result of regression to the mean.

If I have the time over the weekend I'll try this with a couple of other moving averages - specifically the EMA 21 and the MA 20. Needless to say I could get really classy and start combining long and short term averages and if I don't get too confused I might try it.

I used Stockfetcher.com for my filtering and backtesting software. Different date ranges and exit settings will necessarily yield different results.

Wednesday, November 22, 2006

Wraps a Wednesday

Good day - but I missed most of it - including an opportunity to sell GM a dollar higher than where I did sell it. I think it has bottomed and I re-bought it at the close for a swing trade. Otherwise I was out most of the day.

For Friday it will probably be more of the same since it is a short day. The up/down ratio is 50%, the VIX is back to neutral, the new 20 day highs added a few to 854 and the new 20 day lows took off a few to 182.

The three sisters and the ugly stepsister and the proxy for the 22nd century all finished strong and white in the last hour. I think that all the above means an up day on Friday.

The magic coin adds another and prints 33 and 19 and for tomorrow ... heads - bull market continues - who believes a magic coin.

For Friday it will probably be more of the same since it is a short day. The up/down ratio is 50%, the VIX is back to neutral, the new 20 day highs added a few to 854 and the new 20 day lows took off a few to 182.

The three sisters and the ugly stepsister and the proxy for the 22nd century all finished strong and white in the last hour. I think that all the above means an up day on Friday.

The magic coin adds another and prints 33 and 19 and for tomorrow ... heads - bull market continues - who believes a magic coin.

Tuesday, November 21, 2006

Tuesday's Wraps

I already discussed the trades of the day - including the one I should have taken in place of the one I did take - but that's today and there is always tomorrow. Speaking of tomorrow it will probably be just like today. The up/down ratio is 50%, the new 20 day highs increased again by about a 100 and new 20 lows stayed in the low 200's. The VIX remains only about 5% below its 10 day MA. But the three sisters, the ugly stepsister and the proxy for the 22nd century all finished in the last hour white. It looks to me as if it will be a low volatility day as everyone is making their break for the seashore.

The magic coin racks up another win today and gets to 32 and 19. For tomorrow it says ... heads - bull again - probably will.

The magic coin racks up another win today and gets to 32 and 19. For tomorrow it says ... heads - bull again - probably will.

I Kid You Knot

Believe it knot I missed KNOT again. How can one person be so dense? Here it is - see if you can pick up the trade without my annotations to get in the way.

I did play AMR for a bit and closed my ATHR trade for a nice profit - then I blew it all on GM - still holding a handful of shares 80 cents under water - thankfully I didn't take a major position. It might work out OK in the next couple of days - we'll see.

I did play AMR for a bit and closed my ATHR trade for a nice profit - then I blew it all on GM - still holding a handful of shares 80 cents under water - thankfully I didn't take a major position. It might work out OK in the next couple of days - we'll see.

Gap-Up Play

I don't play many gap-ups but I do look for them because they have a distinct set up formation. On Monday however I missed an excellent gap-up in KNOT. Here is what that looks like in the 30-minute version.

You can see that I use the EMA's 4, 8 and 21 - I used to use the simple moving averages but I have found that the exponentials suit my trading style and so I prefer them. Note that this is a preference only - others prefer the SMA - to each his own. In this set up there is a gap-up of indeterminant range. The next one to three candles slide sideways until the price returns to the 4 EMA. From there it is just a waiting game. I have put two entry points on the chart - an aggressive one which is the one I usually take and a more conservative one - again to each his own. Later in the day you start seeing steeples and, with the village in sight, it is time to think about ending this trip. That should come with the second to last candle if not the last.

Interestingly enough on 30-minute charts there is yet one more entry opportunity right after the large red candle but I would consider that to be a dangerous place because it is afternoon. Some people play then - I don't normally start trades in the afternoon.

Because we don't mess around in this Blog here is the same trade except on a 15-minute basis.

This one is actually showing you a dummy spot (that little red Doji in the 4th candle. If the next candle was a substantial hammer it would have been the entry point but it wasn't so we continue waiting for the set-up to develop.

Basically the entry and exit points are about the same but there is one critical difference between 15-minute and 30-minute set-ups - see it? That's right - on the 15-minute chart the price should return inside the 4 EMA and almost or actually touch the 8 EMA. Again there are two normal buy points - one conservative and one aggressive. And once again when you start seeing the steeples you are approaching the village and it is time to start thinking about ending the journey.

Once more there is a tertiary entry point around 1 P.M. right after that red Doji (dummy spot) that hit the 8 EMA. I consider this to be a little less dangerous entry than the one shown on 30-minute charts but only because of the fact that it is a Doji, it is rebounding from the 8 EMA, and it is followed by a hammer.

It is important to note that while set ups appear equivalent across time frames there is usually a little something that is different. For example the difference between the 4 and 8 EMA's. Now you won't always see that effect but I like to see it because it raises the probability of the trade being a success in my process.

Again all charts from prophet.net with annotations done in power point (thanks Mr. Softee) and based on set ups that I first learned from the King - Trader X. He probably wouldn't recognize these but everyone has their own methods that keeps them in the comfort zone.

You can see that I use the EMA's 4, 8 and 21 - I used to use the simple moving averages but I have found that the exponentials suit my trading style and so I prefer them. Note that this is a preference only - others prefer the SMA - to each his own. In this set up there is a gap-up of indeterminant range. The next one to three candles slide sideways until the price returns to the 4 EMA. From there it is just a waiting game. I have put two entry points on the chart - an aggressive one which is the one I usually take and a more conservative one - again to each his own. Later in the day you start seeing steeples and, with the village in sight, it is time to think about ending this trip. That should come with the second to last candle if not the last.

Interestingly enough on 30-minute charts there is yet one more entry opportunity right after the large red candle but I would consider that to be a dangerous place because it is afternoon. Some people play then - I don't normally start trades in the afternoon.

Because we don't mess around in this Blog here is the same trade except on a 15-minute basis.

This one is actually showing you a dummy spot (that little red Doji in the 4th candle. If the next candle was a substantial hammer it would have been the entry point but it wasn't so we continue waiting for the set-up to develop.

Basically the entry and exit points are about the same but there is one critical difference between 15-minute and 30-minute set-ups - see it? That's right - on the 15-minute chart the price should return inside the 4 EMA and almost or actually touch the 8 EMA. Again there are two normal buy points - one conservative and one aggressive. And once again when you start seeing the steeples you are approaching the village and it is time to start thinking about ending the journey.

Once more there is a tertiary entry point around 1 P.M. right after that red Doji (dummy spot) that hit the 8 EMA. I consider this to be a little less dangerous entry than the one shown on 30-minute charts but only because of the fact that it is a Doji, it is rebounding from the 8 EMA, and it is followed by a hammer.

It is important to note that while set ups appear equivalent across time frames there is usually a little something that is different. For example the difference between the 4 and 8 EMA's. Now you won't always see that effect but I like to see it because it raises the probability of the trade being a success in my process.

Again all charts from prophet.net with annotations done in power point (thanks Mr. Softee) and based on set ups that I first learned from the King - Trader X. He probably wouldn't recognize these but everyone has their own methods that keeps them in the comfort zone.

Tech Leads

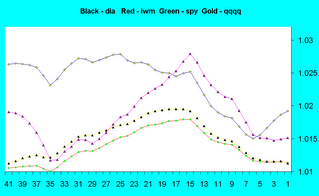

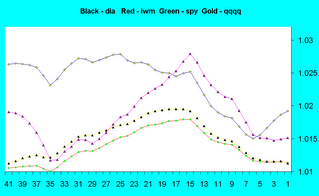

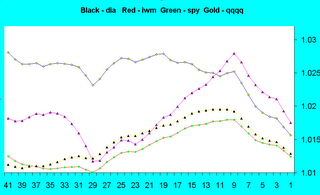

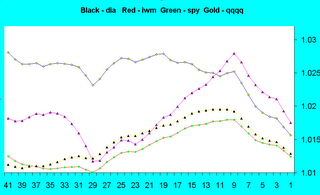

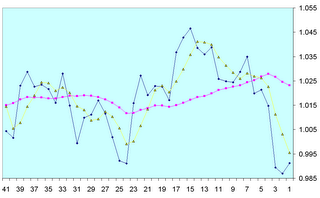

Well this is just the old diagram of the three sisters and the ugly step sister (IWM) updated to the 20th of November but as I was looking at this this morning it suddenly occurred to me what I was looking at - good old fashioned tech leadership in a bull rally!

"Old fashioned" - right. Anyway for you purists out there this is the proof that the bull rally is for real (at least this week's version of it). A couple of other things to note - IWM is flattening out and finally rolling over. While barely perceptable the ticks in the IWM line are closer together than they were a week ago. Another thing to note is that the SPY is finally crossing over the DIA so maybe the major market will participate to the end of the year now that the INDU has had its day in the sun.

I don't know but I thought this stuff was interesting. You can go back to sleep now.

"Old fashioned" - right. Anyway for you purists out there this is the proof that the bull rally is for real (at least this week's version of it). A couple of other things to note - IWM is flattening out and finally rolling over. While barely perceptable the ticks in the IWM line are closer together than they were a week ago. Another thing to note is that the SPY is finally crossing over the DIA so maybe the major market will participate to the end of the year now that the INDU has had its day in the sun.

I don't know but I thought this stuff was interesting. You can go back to sleep now.

Labels:

bull rally,

DIA,

IWM,

QQQQ,

SPY,

tech leadership.

Monday, November 20, 2006

Crazy Wrapping Monday

What a day - I didn't feel right all day so all I did was manage my "investment" (ATHR) and I sold it in early afternoon for a 50 cent gain (over the 14 cents I was down on Friday). Then later it set up again and I bought it again and now I'm plus 13 cents and hoping for another gap up tomorrow. This is a crazy game.

On Friday I said that the market was going up today and, I don't know, but if two of the three sisters go up, the ugly step sister goes up and the proxy for the market of the 22nd century goes up and if only the dumb old Dow Jones Industrials went down did the market go down? (Of course I'm talking about the ETFs DIA, SPY, QQQQ, and IWM above and not the indices they reflect.) (And why "of course" because if I wanted to I could play the cash market using those elements and that's what I'm all about - playing.) GS didn't make the 2 handle like I thought it would - maybe later this week or early next.

Yes, the market went up - it tried to go down in mid-afternoon off a housing report. But seriously who here didn't know that housing was in trouble? Obviously the entire trading community that's who - they started selling with both hands when the report came out. Morons.

Tomorrow - more of the same. Why? Because the up/down ratio edged back up to 45%, the new 20 day highs went to 668 from 575 and the new 20 day lows stayed about where they were at 212. The VIX, although it printed a single digit handle this evening still remains only about 6% below its 10 day MA and all the sisters, the ugly step sister and the proxy of the 22nd century all finished with strong white candles in the last hour. Put it all together in Thanksgiving week and you've got low volume trading in stocks that are barely going anywhere.

The magic coin loses another and now sits at 31 and 19 and for tomorrow --- heads - bull market - probably.

On Friday I said that the market was going up today and, I don't know, but if two of the three sisters go up, the ugly step sister goes up and the proxy for the market of the 22nd century goes up and if only the dumb old Dow Jones Industrials went down did the market go down? (Of course I'm talking about the ETFs DIA, SPY, QQQQ, and IWM above and not the indices they reflect.) (And why "of course" because if I wanted to I could play the cash market using those elements and that's what I'm all about - playing.) GS didn't make the 2 handle like I thought it would - maybe later this week or early next.

Yes, the market went up - it tried to go down in mid-afternoon off a housing report. But seriously who here didn't know that housing was in trouble? Obviously the entire trading community that's who - they started selling with both hands when the report came out. Morons.

Tomorrow - more of the same. Why? Because the up/down ratio edged back up to 45%, the new 20 day highs went to 668 from 575 and the new 20 day lows stayed about where they were at 212. The VIX, although it printed a single digit handle this evening still remains only about 6% below its 10 day MA and all the sisters, the ugly step sister and the proxy of the 22nd century all finished with strong white candles in the last hour. Put it all together in Thanksgiving week and you've got low volume trading in stocks that are barely going anywhere.

The magic coin loses another and now sits at 31 and 19 and for tomorrow --- heads - bull market - probably.

Sunday, November 19, 2006

Farming

Michelle B on Trader Mike writes about finding a niche - I put it differently - I say you need to look at your trading as if you were farming. You put in a couple of crops and watch them grow. A farmer doesn't grow every possible vegetable in the world, he grows what his particular land will carry and what he knows about. You really can't go from tomatoes to potatoes you know, at least not in bulk. First place even though tomatoes will grow just about anywhere you really do need special soil for potatoes - sandy with very little clay is about right. Otherwise you'll be growing marbles and don't worry if you don't know why - it really doesn't matter. Point is you need to specialize not only in the type of trades you will take but what you will trade in. You need to find your comfort zone.

I only like to play on the long side of the market - first I know that method and second the bias of the market is long. While I could adapt my methods to play the short side my head nor heart would be in it and I would fail. It would be awful to be making money on the long side and giving it away short. Also I have enough trouble finding stocks to take a position in on the long side - I can't imagine what it might be like going short.

For catching potential longs I developed a couple of screens that look for gap downs and gap ups and what I found after several weeks is that the same stocks were always coming up on my screens. Apparently stocks have a personality and some of them can't go up unless they first dip down and some can't go up unless they gap up to start then dip down. So after awhile I just made a list of the common elements and what some would call a watch list I call my "farm".

I play stocks from that list more than any others because I know how they react in various market conditions. Of course it isn't the stock that is reacting but the traders of that stock who are reacting and I know their moves. I know when a certain candlestick formation sets up what will happen next with a high probability of success. So just like a farmer who knows how much a given field will yield given a certain mix of fertilizer and water I know how my fields will behave given a certain mix of price and volume.

And I find that both comfortable and profitable. The best part of this is when a field is played out I know that too and can then look for a new crop to farm.

I only like to play on the long side of the market - first I know that method and second the bias of the market is long. While I could adapt my methods to play the short side my head nor heart would be in it and I would fail. It would be awful to be making money on the long side and giving it away short. Also I have enough trouble finding stocks to take a position in on the long side - I can't imagine what it might be like going short.

For catching potential longs I developed a couple of screens that look for gap downs and gap ups and what I found after several weeks is that the same stocks were always coming up on my screens. Apparently stocks have a personality and some of them can't go up unless they first dip down and some can't go up unless they gap up to start then dip down. So after awhile I just made a list of the common elements and what some would call a watch list I call my "farm".

I play stocks from that list more than any others because I know how they react in various market conditions. Of course it isn't the stock that is reacting but the traders of that stock who are reacting and I know their moves. I know when a certain candlestick formation sets up what will happen next with a high probability of success. So just like a farmer who knows how much a given field will yield given a certain mix of fertilizer and water I know how my fields will behave given a certain mix of price and volume.

And I find that both comfortable and profitable. The best part of this is when a field is played out I know that too and can then look for a new crop to farm.

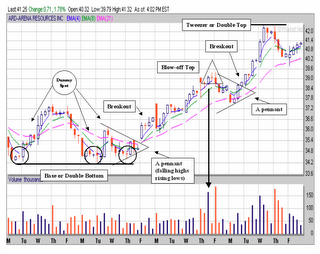

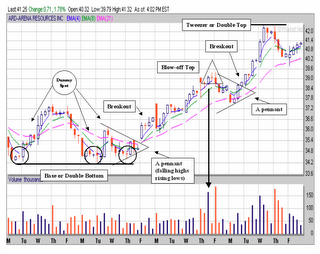

Technical Analysis 101

My reader (thanks Mom) wants to know if I remember saying that all technical analysis sucks? – Actually I do but I was talking about all the stuff that is related to manipulating moving averages (and simple moving averages at that) such as rate of change, momentum, and so on. But as I say –just because I don’t like it doesn’t mean I don’t know how to use it.*

My basic problem with most TA is that too many people rely too heavily on it to the exclusion of ever knowing what they are doing. I know this because I was once one of those people. I became a much better trader once I started taking the various programs apart and looking at all of their moving parts. After I did that I began to understand what all these squiggly lines was trying to say. Unfortunately a lot of what they were saying I already knew just by looking at the price patterns and once I realized that - well the rest is history.

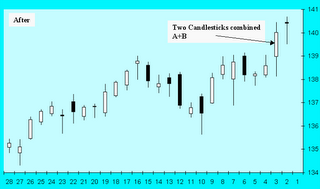

As my reader knows I use a lot of candlestick based TA and I like a breakout from congestion as much as the next guy. Anyway I was looking through some charts this morning in my favorite format, which is 2-hour increments and I came across this one – ARD. A quick glance revealed that it was a veritable clinic in pennants, and dummy spots and tweezer tops and double bottoms and so on. It also had a crisp example of a blow-off top on Thursday before last – which is something you don’t see very often unless you are looking for it.

The blow-off top is characterized by one huge buying push (by volume) followed by a Doji (or what I call a steeple) most often in red followed by a huge volume red candle of any kind. We also had a tweezer top in this particular formation just in case you didn’t get the significance of the rest of it. I call that long necked candle a steeple because in the old days the church steeple was always the highest point in the village and if you think about it – that’s what this signifies.

Anyway for your viewing pleasure complete with markups and everything else you once had to pay for but now can get for free – I give you Technical Analysis 101. (Charts as usual from prophet.net – an excellent site).

One more lesson - if TA is going to work it has to work across all time frames and it must work consistently across all time frames. Much of what passes for TA these days only works well on closing prices and any attempt to use it on a shorter frequency might lead to your early demise as a trader. Be careful.

* (Actually Tom Selleck’s character said it in the movie Quigley Down Under. And he was talking about a .45 caliber wheel gun.)

My basic problem with most TA is that too many people rely too heavily on it to the exclusion of ever knowing what they are doing. I know this because I was once one of those people. I became a much better trader once I started taking the various programs apart and looking at all of their moving parts. After I did that I began to understand what all these squiggly lines was trying to say. Unfortunately a lot of what they were saying I already knew just by looking at the price patterns and once I realized that - well the rest is history.

As my reader knows I use a lot of candlestick based TA and I like a breakout from congestion as much as the next guy. Anyway I was looking through some charts this morning in my favorite format, which is 2-hour increments and I came across this one – ARD. A quick glance revealed that it was a veritable clinic in pennants, and dummy spots and tweezer tops and double bottoms and so on. It also had a crisp example of a blow-off top on Thursday before last – which is something you don’t see very often unless you are looking for it.

The blow-off top is characterized by one huge buying push (by volume) followed by a Doji (or what I call a steeple) most often in red followed by a huge volume red candle of any kind. We also had a tweezer top in this particular formation just in case you didn’t get the significance of the rest of it. I call that long necked candle a steeple because in the old days the church steeple was always the highest point in the village and if you think about it – that’s what this signifies.

Anyway for your viewing pleasure complete with markups and everything else you once had to pay for but now can get for free – I give you Technical Analysis 101. (Charts as usual from prophet.net – an excellent site).

One more lesson - if TA is going to work it has to work across all time frames and it must work consistently across all time frames. Much of what passes for TA these days only works well on closing prices and any attempt to use it on a shorter frequency might lead to your early demise as a trader. Be careful.

* (Actually Tom Selleck’s character said it in the movie Quigley Down Under. And he was talking about a .45 caliber wheel gun.)

Labels:

ARD,

breakout trading,

candlesticks,

Technical analysis

Saturday, November 18, 2006

Marlyn's Curve - Revisited

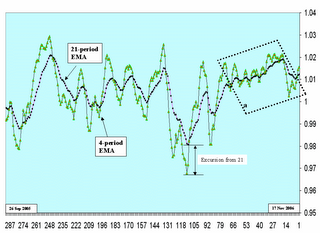

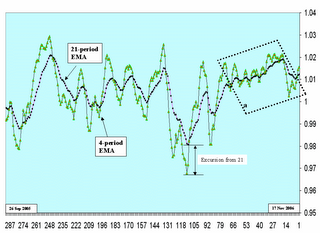

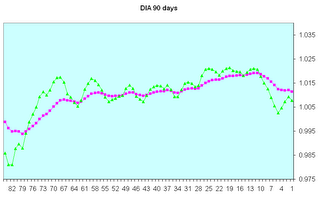

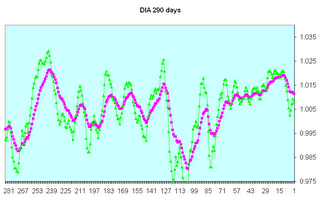

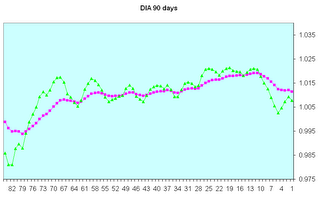

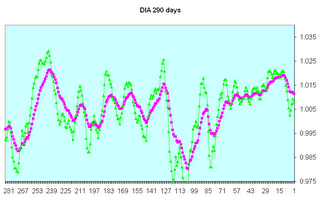

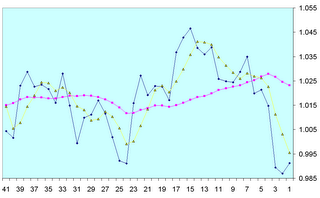

We've used the Marlyn's curve on the site to demonstrate a number of points - some I'm sure you've agreed with and others - well are you going to believe your lying eyes or not? But I want to emphasize that Marlyn's curve is used in the most part for information, to inform, and not as a trading device unless you know what you are doing. Even then it is only a sentiment indicator no better nor worse than any other - the only difference being by using Marlyn's curve I can compare two disparate stocks and make decisions regarding one or the other of them just based on the comparison. You've seen this a number of times on the site. For example I've shown you how the RYDEX funds compete with one another and how oil and airlines work together (or against one another) and in a recent post - how the Dow theory might not be all that it is cracked up to be. Today I'd like to discuss the curve as a trading tool and explain the components.

For comparisons any simple moving average will work and I usually use the 20-period moving average of the 20-period normalized returns for that purpose. But for trading I like to kick it up a notch (as somebody famous usually says - love that spaghetti sauce by the way) and use the EMA's of the 20-period normalized returns. Someday when I have the time I'm going to test a method where I normalize the returns using and EMA but for now it is a simple method. Anyway looking at the picture what we see is that part I showed recently (in the dotted box) that shows why we day traders have been having such a hard time this summer and fall.

Recently we had a nice downturn for a bit and now it appears that the INDU is turning back up again. I use two averages in conjunction like this so I can understand what is happening in the near and intermediate term simultaneously.

The 21-period EMA is used to determine overall market sentiment. I.E. what is the trading community at large feeling about the market as a whole. I generally wait for three days to decide whether the market is turning up or down after a major turn. This is why the last 80 days or so have been so difficult - every 3 days the sentiment changed. It whipped back and forth in a directionless manner for weeks and weeks even though it was generally going up. I think this was a result of the transportation average being off so far. Traders who believe in the Dow theory were trying to beat the market down but the dynamic of the market in a totally hedged environment is up up up. I'm talking in global generalities now because when you talk about something as large as the market you really only can generalize.

But again the evidence in box a is overwhelming in its message. We have just gone through an extremely unusual period in the market and - are you ready for this - nobody noticed. At least nobody who makes a living with a blog or on TV. But even if they had noticed the story is so difficult to tell with their primitive tools they simply couldn't tell it. Even I can't really tell it because it is all after the fact. I can only point backward and say see - that's what happened.

I use the 4-period EMA to inform my trading. I watch it as it runs away from the 21-period and when it gets to a certain point it generally turns. This "certain point" is not some hard and fast value - I just start getting ready as the difference grows.

I use this also in my daily trading where I watch the excursion of the EMA-4 away from the EMA-21 and if certain candles start forming when that difference seems excessive - I close the trade.

The other thing that happens when the market direction changes is the momentum starts slowing. Note that you can see this in the major curve by the fact that the ticks get closer together. Then when the market is running the ticks get further appart. See how in the directionless period the ticks never separated by much at all. Again this is a feel or a sensation not a hard fast measurement. I suppose I could average it but then it becomes institutionalized as a metric and most metrics are absolute crap. This would be one of those.

The other interesting thing is that the major curve pretty much stays between .98 and 1.02 or a 2% maximum excursion from 0. But that's another useless metric that you needn't put any stock into.

The only value of Marlyn's curve other than being able to compare issues is to show the sentiment of the market as a whole and to kinda sorta halfassed predict turns - and that's it. But isn't that the story of most TA?

For comparisons any simple moving average will work and I usually use the 20-period moving average of the 20-period normalized returns for that purpose. But for trading I like to kick it up a notch (as somebody famous usually says - love that spaghetti sauce by the way) and use the EMA's of the 20-period normalized returns. Someday when I have the time I'm going to test a method where I normalize the returns using and EMA but for now it is a simple method. Anyway looking at the picture what we see is that part I showed recently (in the dotted box) that shows why we day traders have been having such a hard time this summer and fall.

Recently we had a nice downturn for a bit and now it appears that the INDU is turning back up again. I use two averages in conjunction like this so I can understand what is happening in the near and intermediate term simultaneously.

The 21-period EMA is used to determine overall market sentiment. I.E. what is the trading community at large feeling about the market as a whole. I generally wait for three days to decide whether the market is turning up or down after a major turn. This is why the last 80 days or so have been so difficult - every 3 days the sentiment changed. It whipped back and forth in a directionless manner for weeks and weeks even though it was generally going up. I think this was a result of the transportation average being off so far. Traders who believe in the Dow theory were trying to beat the market down but the dynamic of the market in a totally hedged environment is up up up. I'm talking in global generalities now because when you talk about something as large as the market you really only can generalize.

But again the evidence in box a is overwhelming in its message. We have just gone through an extremely unusual period in the market and - are you ready for this - nobody noticed. At least nobody who makes a living with a blog or on TV. But even if they had noticed the story is so difficult to tell with their primitive tools they simply couldn't tell it. Even I can't really tell it because it is all after the fact. I can only point backward and say see - that's what happened.

I use the 4-period EMA to inform my trading. I watch it as it runs away from the 21-period and when it gets to a certain point it generally turns. This "certain point" is not some hard and fast value - I just start getting ready as the difference grows.

I use this also in my daily trading where I watch the excursion of the EMA-4 away from the EMA-21 and if certain candles start forming when that difference seems excessive - I close the trade.

The other thing that happens when the market direction changes is the momentum starts slowing. Note that you can see this in the major curve by the fact that the ticks get closer together. Then when the market is running the ticks get further appart. See how in the directionless period the ticks never separated by much at all. Again this is a feel or a sensation not a hard fast measurement. I suppose I could average it but then it becomes institutionalized as a metric and most metrics are absolute crap. This would be one of those.

The other interesting thing is that the major curve pretty much stays between .98 and 1.02 or a 2% maximum excursion from 0. But that's another useless metric that you needn't put any stock into.

The only value of Marlyn's curve other than being able to compare issues is to show the sentiment of the market as a whole and to kinda sorta halfassed predict turns - and that's it. But isn't that the story of most TA?

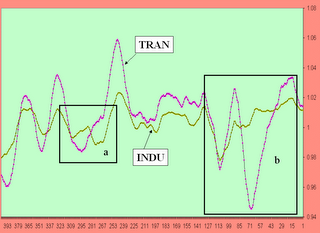

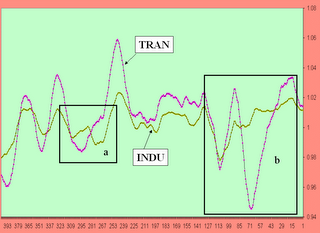

Dow Theory

The Dow theory is simple as can be - whither the transportation index there the Industrials. In other words one doesn't move without the other and if they do the earth stands still and everything that we know and love turns to ....

Not so. In general the tranny's and the indu's track together and play nice and as the following chart shows for the past two years that only two times on a global basis did they diverge - once briefly, box a, and once tremendously, box b.

I know, I know what you are saying to yourself right now - "where in the hell does he get such ugly colors," but seriously, can we be serious for a moment -

As shown in box a when the INDU's realized that the TRAN's were going up they rushed to catch up. But box b is most interesting because this was what was happening that many of the bobbleheads and blogheads (many instances same difference) were talking about this past summer - you know as the Dow was making a run at a new record how - "The trannies are crashing! The trannies are crashing! The world as we know it must come to an end." And it didn't.

Point being kiddies who're ya gonna trust - the bobbleheads or your own lying eyes?

Stop worrying about things like the Dow theory - it obviously doesn't work as some folks want it to. It might have used to done that back when buggy whips were all the rage but apparently in the age of microsoft it don't work that way so much no more. And despite the horrendous grammar - you get the point.

Not so. In general the tranny's and the indu's track together and play nice and as the following chart shows for the past two years that only two times on a global basis did they diverge - once briefly, box a, and once tremendously, box b.

I know, I know what you are saying to yourself right now - "where in the hell does he get such ugly colors," but seriously, can we be serious for a moment -

As shown in box a when the INDU's realized that the TRAN's were going up they rushed to catch up. But box b is most interesting because this was what was happening that many of the bobbleheads and blogheads (many instances same difference) were talking about this past summer - you know as the Dow was making a run at a new record how - "The trannies are crashing! The trannies are crashing! The world as we know it must come to an end." And it didn't.

Point being kiddies who're ya gonna trust - the bobbleheads or your own lying eyes?

Stop worrying about things like the Dow theory - it obviously doesn't work as some folks want it to. It might have used to done that back when buggy whips were all the rage but apparently in the age of microsoft it don't work that way so much no more. And despite the horrendous grammar - you get the point.

Friday - Itsa Wrap