Prices go up and down as a result of supply and demand. If there is no supply but a great demand price will go up and vice versa. Momentum is affected by the amount of demand not by the price - if something was once very expensive - e.g. buggy whips - and they are now a dime a dozen - e.g. buggy whips - but no one wants one - e.g. buggy whips - it doesn't matter how much they cost - does it?

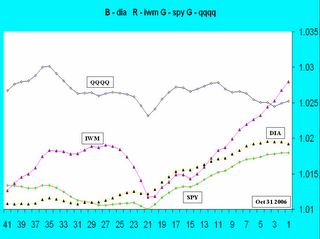

The fact of the matter is that the large cap stocks are mostly overpriced and the momentum is coming out of that market while the small caps and the tech stocks are being chased. The proof is in the following diagram where I clearly show, using Marlyn's curve, that the DIA and SPY are both turning down, the Q's are button hooking up and the IWM continues the rise begun some 20 days ago.

Remember Marlyn's curve acts on returns which are spendable not price which is not.

No comments:

Post a Comment