My basic problem with most TA is that too many people rely too heavily on it to the exclusion of ever knowing what they are doing. I know this because I was once one of those people. I became a much better trader once I started taking the various programs apart and looking at all of their moving parts. After I did that I began to understand what all these squiggly lines was trying to say. Unfortunately a lot of what they were saying I already knew just by looking at the price patterns and once I realized that - well the rest is history.

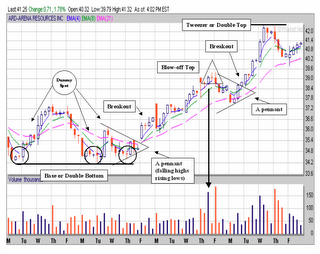

As my reader knows I use a lot of candlestick based TA and I like a breakout from congestion as much as the next guy. Anyway I was looking through some charts this morning in my favorite format, which is 2-hour increments and I came across this one – ARD. A quick glance revealed that it was a veritable clinic in pennants, and dummy spots and tweezer tops and double bottoms and so on. It also had a crisp example of a blow-off top on Thursday before last – which is something you don’t see very often unless you are looking for it.

The blow-off top is characterized by one huge buying push (by volume) followed by a Doji (or what I call a steeple) most often in red followed by a huge volume red candle of any kind. We also had a tweezer top in this particular formation just in case you didn’t get the significance of the rest of it. I call that long necked candle a steeple because in the old days the church steeple was always the highest point in the village and if you think about it – that’s what this signifies.

Anyway for your viewing pleasure complete with markups and everything else you once had to pay for but now can get for free – I give you Technical Analysis 101. (Charts as usual from prophet.net – an excellent site).

One more lesson - if TA is going to work it has to work across all time frames and it must work consistently across all time frames. Much of what passes for TA these days only works well on closing prices and any attempt to use it on a shorter frequency might lead to your early demise as a trader. Be careful.

* (Actually Tom Selleck’s character said it in the movie Quigley Down Under. And he was talking about a .45 caliber wheel gun.)

No comments:

Post a Comment