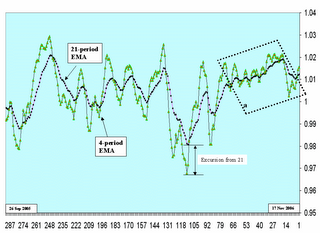

For comparisons any simple moving average will work and I usually use the 20-period moving average of the 20-period normalized returns for that purpose. But for trading I like to kick it up a notch (as somebody famous usually says - love that spaghetti sauce by the way) and use the EMA's of the 20-period normalized returns. Someday when I have the time I'm going to test a method where I normalize the returns using and EMA but for now it is a simple method. Anyway looking at the picture what we see is that part I showed recently (in the dotted box) that shows why we day traders have been having such a hard time this summer and fall.

Recently we had a nice downturn for a bit and now it appears that the INDU is turning back up again. I use two averages in conjunction like this so I can understand what is happening in the near and intermediate term simultaneously.

The 21-period EMA is used to determine overall market sentiment. I.E. what is the trading community at large feeling about the market as a whole. I generally wait for three days to decide whether the market is turning up or down after a major turn. This is why the last 80 days or so have been so difficult - every 3 days the sentiment changed. It whipped back and forth in a directionless manner for weeks and weeks even though it was generally going up. I think this was a result of the transportation average being off so far. Traders who believe in the Dow theory were trying to beat the market down but the dynamic of the market in a totally hedged environment is up up up. I'm talking in global generalities now because when you talk about something as large as the market you really only can generalize.

But again the evidence in box a is overwhelming in its message. We have just gone through an extremely unusual period in the market and - are you ready for this - nobody noticed. At least nobody who makes a living with a blog or on TV. But even if they had noticed the story is so difficult to tell with their primitive tools they simply couldn't tell it. Even I can't really tell it because it is all after the fact. I can only point backward and say see - that's what happened.

I use the 4-period EMA to inform my trading. I watch it as it runs away from the 21-period and when it gets to a certain point it generally turns. This "certain point" is not some hard and fast value - I just start getting ready as the difference grows.

I use this also in my daily trading where I watch the excursion of the EMA-4 away from the EMA-21 and if certain candles start forming when that difference seems excessive - I close the trade.

The other thing that happens when the market direction changes is the momentum starts slowing. Note that you can see this in the major curve by the fact that the ticks get closer together. Then when the market is running the ticks get further appart. See how in the directionless period the ticks never separated by much at all. Again this is a feel or a sensation not a hard fast measurement. I suppose I could average it but then it becomes institutionalized as a metric and most metrics are absolute crap. This would be one of those.

The other interesting thing is that the major curve pretty much stays between .98 and 1.02 or a 2% maximum excursion from 0. But that's another useless metric that you needn't put any stock into.

The only value of Marlyn's curve other than being able to compare issues is to show the sentiment of the market as a whole and to kinda sorta halfassed predict turns - and that's it. But isn't that the story of most TA?

1 comment:

golden goose

supreme hoodie

yeezy shoes

balenciaga trainers

curry shoes

kevin durant shoes

chrome hearts online store

golden goose sneakers

curry 6

kd 12

Post a Comment