The fact is, because of Iraq, all other defense dollars have dried up and the only place where any money is being spent is directly on the war effort and a tremendous amount of that is being used for trying to repair the children who have been hurt so bad during their tour of duty. So believe it or not once the current defense contracts are spent out and spent out they will be there is no more money to either refresh them or start new ones. And in two years, just in time to blame the Democrats in the next election cycle, the country is going to be in a deep, deep recession. You read it here first. So maybe Karl Rove isn't so incompetent after all - and if you don't think he hasn't already thought this through you are wrong wrong wrong wrong - wrong wrong wrong wrong. Did I mention you're wrong.

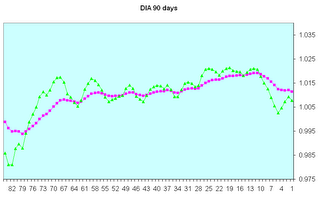

Back to the task at hand which is wither the market this glorious morning and wither is probably up. The futures appear to be signalling thus and the FTSI 100 which was deep red awhile ago might transition to green. If it does I think we will have another one of those directionless days we have grown to love these past several months. Here is what that looks like in case you don't know.

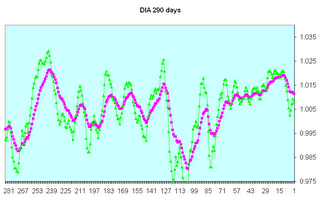

The red line is the 20 day exponential average of the returns of the DIA and the green line is the 5 day EMA of the same. You see how only recently has the 5 day pulled very far away from the 20 day. This is unusual enough to be remarkable. Here is the same figure except the last 290 days are shown.

See how it looks in a more normal manner - the 5 day has a more or less large excursion from the 20 day and the 20 day has some marked ups and downs. When the market has a direction and purpose a trader can make money - when it doesn't you can't - it's that simple.

No comments:

Post a Comment