I read Dr. Brett's BLOG both because I am a believer in the technical aspect of the game (i.e. esoteric stuff such as the Put/Call ratio and the TICK) and I believe in the psychology of the game.

For example - it's 2 A.M. and after a solid 3 hours of sleep I awaken with an idea - most people would go back to sleep - I get up and shuffle over to my office (next to my bedroom) and start to work on it.

I've been trading for a number of years following several other careers that I was also passionate about. I'm not saying that you have to get out of bed at 2 A.M. to prove the point - but if you ever do and it's because of a trading idea - then you probably want to do this job for a long time.

By the way - it's 5:30 A.M. the idea didn't work out - but I'm up now so I might as well put on a pot of coffee and get ready to go to work. The overnights (futures) are green and the FTSI is up. It's gonna be a great day!

Passion!

Showing posts with label FTSI 100. Show all posts

Showing posts with label FTSI 100. Show all posts

Thursday, December 07, 2006

Friday, November 17, 2006

Pre-Friday Market - Expiration Day Blues

Looks like a down day - at least until the first shares are sold at the open. Right now (08:30 A.M. EST) the FTSI-100 is red, futures are red and the NASDAQ pre-market indicator is red. I believe that probably suggests a down opening.

But this is expiration day so there is also a good possibility that around noon the market will be turning around and drifting up again - that's if it opens down in the first place.

I will play in my usual way - take a set of gap downs and gap ups at 10 A.M. then work them for an hour or so to see which way the wind is blowing and if I can find a trade - go for it. I try to get 20 of each and if my net catches too many I only take the top volume stocks. I know I'm probably missing some good opportunities but, hey, this is working and I have a simple rule - keep it simple, if something works don't fix it.

Anyway we'll see you later with a new original post that I will call "Candletricks" - watch for it - you will be amazed and astounded, or something.

But this is expiration day so there is also a good possibility that around noon the market will be turning around and drifting up again - that's if it opens down in the first place.

I will play in my usual way - take a set of gap downs and gap ups at 10 A.M. then work them for an hour or so to see which way the wind is blowing and if I can find a trade - go for it. I try to get 20 of each and if my net catches too many I only take the top volume stocks. I know I'm probably missing some good opportunities but, hey, this is working and I have a simple rule - keep it simple, if something works don't fix it.

Anyway we'll see you later with a new original post that I will call "Candletricks" - watch for it - you will be amazed and astounded, or something.

Tuesday, November 14, 2006

Tuesday Warm Up

Well folks, everything I see this morning says going to be a consolidation (sideways) day at best. After yesterday the urge to own may turn into an urge to purge. There is no one thing - it is simply a compendium of "stuff". For example volumes in many individual shares yesterday were out of sight. Increased volume is generally a good thing, blow-out volume is a bad thing - most of yesterday's was blow-out levels coupled with the fact that many issues finished well off their highs. The exceptions (there are always exceptions) were found in the NASDAQ where many tech stocks stayed at their peaks.

Last Thursday there was some kind of mini-bottoming event that I know that I missed and I doubt that very many others saw it. The TICK hit a major low in the 1:30 - 3:30 period and after that the market just sort of loosened up resultint in yesterday's action. Yesterday it did it again in the 11:30 to 1:30 period and that brought the rest of the market to its knees - but not the NASDAQ. And the run up in NASDAQ stocks yesterday was broadbased - in other words most of the index participated.

Currently the FTSI 100 is coming off its highs which doesn't usually happen after a U.S. blow out and the fact is the FTSI was in the red for most of yesterday's session as well. Given that only the NASDAQ actually surged forward yesterday with everything else backing up starting in the 11:30 time frame can only mean one of two things. Either the vaunted NASDAQ tech stock leadership is starting to realize that the parade is way ahead of it and it needs to run to get to the lead or tech stocks are going to have a fire sale today.

I'm opting for door number two because the other piece of bad news of the morning is that the futures are starting to collapse. While I don't put much stock in the futures (bad pun) as a predictor when you put that fact together with the other facts it looks like a good day to sit and watch and I think that's what I'm going to do.

Update 09:00 - apparently all is forgotten - futures have turned around as has the FTSI. This, of course, has to do with the fact that the PPI indicates lower inflation so the Fed won't have to raise any more ever again.

Buy with both hands folks - you won't get another chance like this for at least 24 hours.

Last Thursday there was some kind of mini-bottoming event that I know that I missed and I doubt that very many others saw it. The TICK hit a major low in the 1:30 - 3:30 period and after that the market just sort of loosened up resultint in yesterday's action. Yesterday it did it again in the 11:30 to 1:30 period and that brought the rest of the market to its knees - but not the NASDAQ. And the run up in NASDAQ stocks yesterday was broadbased - in other words most of the index participated.

Currently the FTSI 100 is coming off its highs which doesn't usually happen after a U.S. blow out and the fact is the FTSI was in the red for most of yesterday's session as well. Given that only the NASDAQ actually surged forward yesterday with everything else backing up starting in the 11:30 time frame can only mean one of two things. Either the vaunted NASDAQ tech stock leadership is starting to realize that the parade is way ahead of it and it needs to run to get to the lead or tech stocks are going to have a fire sale today.

I'm opting for door number two because the other piece of bad news of the morning is that the futures are starting to collapse. While I don't put much stock in the futures (bad pun) as a predictor when you put that fact together with the other facts it looks like a good day to sit and watch and I think that's what I'm going to do.

Update 09:00 - apparently all is forgotten - futures have turned around as has the FTSI. This, of course, has to do with the fact that the PPI indicates lower inflation so the Fed won't have to raise any more ever again.

Buy with both hands folks - you won't get another chance like this for at least 24 hours.

Labels:

FTSI 100,

futures,

NASDAQ,

stock futures,

stock market,

tech leadership.

Friday, November 10, 2006

Friday Pre-Market

The other day (Wednesday) I mentioned that the FTSI 100 was in the red and that usually foreshadowed a down day in the U.S. markets - it started out that way and then Don Rumsfeld resigned (read: was fired) and the stock market took that as a good thing - although I don't know why. On Thursday it sobered up and realized that having an incompetent asshole as the head of the military was a good thing and now, although the new guy is just as incompetent, it won't be a smooth transition. In fact there might be some adult supervision over the various billions and billions of dollars being pissed down the rabbit hole so defense-based profits might dry up a bit.

The fact is, because of Iraq, all other defense dollars have dried up and the only place where any money is being spent is directly on the war effort and a tremendous amount of that is being used for trying to repair the children who have been hurt so bad during their tour of duty. So believe it or not once the current defense contracts are spent out and spent out they will be there is no more money to either refresh them or start new ones. And in two years, just in time to blame the Democrats in the next election cycle, the country is going to be in a deep, deep recession. You read it here first. So maybe Karl Rove isn't so incompetent after all - and if you don't think he hasn't already thought this through you are wrong wrong wrong wrong - wrong wrong wrong wrong. Did I mention you're wrong.

Back to the task at hand which is wither the market this glorious morning and wither is probably up. The futures appear to be signalling thus and the FTSI 100 which was deep red awhile ago might transition to green. If it does I think we will have another one of those directionless days we have grown to love these past several months. Here is what that looks like in case you don't know.

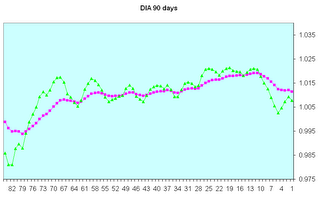

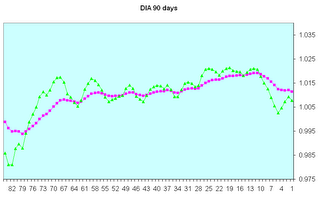

The red line is the 20 day exponential average of the returns of the DIA and the green line is the 5 day EMA of the same. You see how only recently has the 5 day pulled very far away from the 20 day. This is unusual enough to be remarkable. Here is the same figure except the last 290 days are shown.

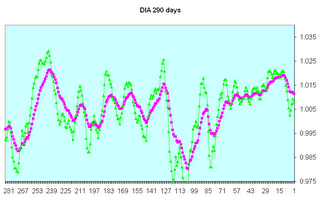

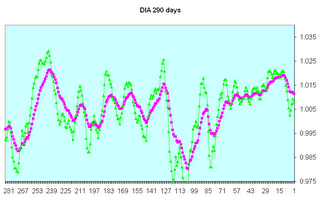

See how it looks in a more normal manner - the 5 day has a more or less large excursion from the 20 day and the 20 day has some marked ups and downs. When the market has a direction and purpose a trader can make money - when it doesn't you can't - it's that simple.

The fact is, because of Iraq, all other defense dollars have dried up and the only place where any money is being spent is directly on the war effort and a tremendous amount of that is being used for trying to repair the children who have been hurt so bad during their tour of duty. So believe it or not once the current defense contracts are spent out and spent out they will be there is no more money to either refresh them or start new ones. And in two years, just in time to blame the Democrats in the next election cycle, the country is going to be in a deep, deep recession. You read it here first. So maybe Karl Rove isn't so incompetent after all - and if you don't think he hasn't already thought this through you are wrong wrong wrong wrong - wrong wrong wrong wrong. Did I mention you're wrong.

Back to the task at hand which is wither the market this glorious morning and wither is probably up. The futures appear to be signalling thus and the FTSI 100 which was deep red awhile ago might transition to green. If it does I think we will have another one of those directionless days we have grown to love these past several months. Here is what that looks like in case you don't know.

The red line is the 20 day exponential average of the returns of the DIA and the green line is the 5 day EMA of the same. You see how only recently has the 5 day pulled very far away from the 20 day. This is unusual enough to be remarkable. Here is the same figure except the last 290 days are shown.

See how it looks in a more normal manner - the 5 day has a more or less large excursion from the 20 day and the 20 day has some marked ups and downs. When the market has a direction and purpose a trader can make money - when it doesn't you can't - it's that simple.

Subscribe to:

Posts (Atom)