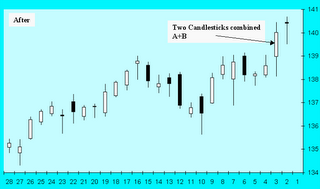

But if you combine Tuesday (A) and Wednesday (B) you get a large spinning top formation which suggests that the market really doesn't know what it wants to do which is obvious from Thursday's action. If you saw it on paper it would look like this -

But of course you would do this in your head, you wouldn't really see it on the page.

2 comments:

That's a lot like looking at daily and weekly candles to determine sentiment - most charting programs let you do that, and it's a good idea.

I always use stockcharts.com, you can use weekly/daily candle charting for clear views of a stock's behavior. That site has done wonders for my P/L in terms of $dollar$ amounts. I absolutely love the CCI Buy/Sell signal scan. Check it out.

Post a Comment