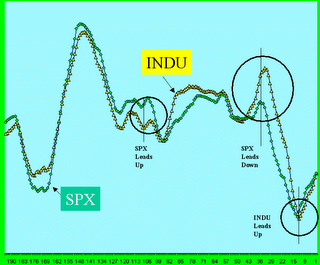

I have compared the INDU to the SPX many times and I always find that the two indices are pretty much carbon copies of one another. Sometimes turns are lead by the SPX and sometimes by the INDU. But when both indices are going in the same direction that is a powerful indicator of general market direction. Now if you were to look at this on a day to day basis you would see the normal ups and downs. Because what is being shown (Marlyn's Curve) is an average it appears more benign. I've filtered the volatility out to make a better presentation.

I track gold because I think that gold is the "canary in the mine" for the world's economy. I don't know why gold all of a sudden started going up, all I know is I don't think it reflects an increased appreciation of jewelry nor is it necessarily a good thing. And whenever you hear the talking heads blovating on the subject - see Rule 1.

1 comment:

adidas yeezy

yeezy supply

golden goose

supreme hoodie

yeezy shoes

balenciaga trainers

curry shoes

kevin durant shoes

chrome hearts online store

golden goose sneakers

Post a Comment