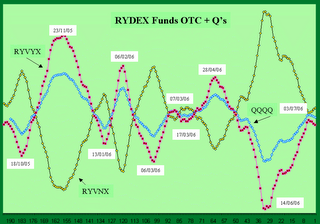

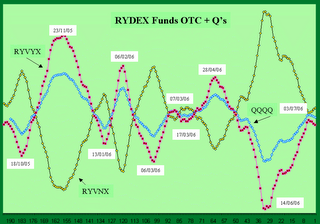

Rydex Dynamic and Inverse index funds have been active for quite some time. They address a need by the market place to permit market timers a place to park their funds when they think the market might be going down (as is currently suspected). The following chart shows three different fund streams, two of the Rydex funds and one of the Q's. The Q's as you know are an exchange traded fund that track the NASDAQ 100. Rydex offers a similar fund, RYVYX. They also offer an inverse fund to the RYVYX named RYVNX. In the chart you can see how the Q's track with the RYVYX (only less volatile) and how the RYVNX tracks exactly opposite to the RYVYX. I've annotated the chart with the dates of the turns for the funds.

Profunds also offers mutual funds like the Rydex funds but Profunds recently brought out a set of ETFs under their Proshares trademark that track inverse to the Q's, the DIA, and the SPY ETFs. These ETFs are called PSQ, DOG, and SH. "DOG" is especially a good name for an inverse fund.

The problem with the Rydex funds is that you can only enter or exit them once a day at the close of business the day before price. The ETFs on the other hand can be bought and sold all day long.

I'm not recommending one or another, just saying that you need to explore these different kinds of trading methods if you want to keep your trading toolbox up to date.

No comments:

Post a Comment