A growth stock is defined by investopedia (investopedia.com) as "a company whose earnings are expected to grow at an above average rate relative to the market."

A value stock is defined as "... stocks include a high dividend yield, low price-to-book ratio and/or low price-to-earnings ratio."

Is that better? No, didn't think so. I looked on the "ishares.com" site at the two of the more popular ETFs - the IWN and IWO. IWN is the Russell 2000 Value ETF and it contains holdings such as Vertex Pharma, Level 3 Comms and Cimmaron Energy to name a few. IWO is the Russell 2000 Growth ETF and it contains names such as Amylin Pharma, Frontier Oil and Hansen Natural (the famous soda maker).

IWM, of course, is the daddy of the Russell 2000 ETFs and contains both IWN and IWO.

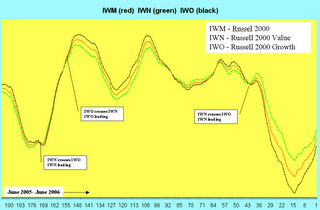

Confused yet? It gets better. If IWM contains both then why not just buy IWM and get it over with? Well that would be a good strategy if you were in doubt or wanted to take an average between the two children but look at this figure first (Marlyn's Curve).

In this figure we see the past year's values for the three funds overlayed on one chart. As you can see IWM rides between the two children. Note that sometimes growth outperforms value and sometimes value outperforms growth. But the important thing to note is that they all move in synch with one another. I.E. When the market goes up - they all go up, when the market comes down - they all come down. So growth or value - I'm not sure how you would choose between them. Maybe this is just one more way for Wall Street to take advantage of you.

No comments:

Post a Comment