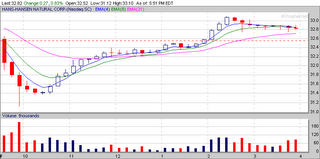

This is the HANS chart - see the "dummy spot" at the 6th stick? This is followed by a confirmation in the next stick and that is a wonderful place to buy. Especially if it is a stock you trust to go up. The reason why I trust it to go up is because so many other traders are gaming the same spots. Consequently we all see the same thing and we all make the same buying action.

I also watch for high volatility stocks that have dropped as a result of a bad earnings report. For example CTXS crashed and burned on Thursday and now it could oscillate up and down for several days to weeks and might prove to be like a fruit tree in a garden and provide numerous opportunities to harvest profits on a daily basis. SNDK is another one in that genre - took a 20% haircut on Friday - I'm keeping it on a watch list and am going to try to harvest a number of opportunities from it. HANS has also been a good “earner” for me in that it is up and down like a yo-yo. In the last 15 days there were 10 opportunities to take a day trade long in HANS.

You don't need a crystal ball just an imagination and a good set of charting software. I use prophet.net and find it excellent - you can try it out for free you just won't get real-time charting capabilities but you will get real-time scans. I get nothing from this endorsement so go ahead and give it a looksee.

No comments:

Post a Comment