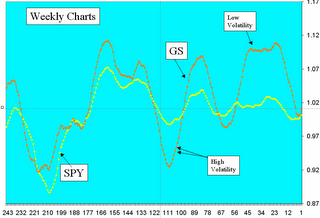

Here is GS overlayed with SPY on their weekly charts. Note that the two dance together very nicely.

But also note one more critically important item - GS volatility is much more visible than is the SPY's. That is very important. It is important because you can use the volatility indicator (or lack thereof) to signal market turning points. When the volatility goes out of GS - and it is obvious when that happens then, in most instances, we are coming up to a major turn in the market. Note that volatility has just increased in GS after a period of low volatility - and it seems to be turning up. What do you think that means?

No comments:

Post a Comment