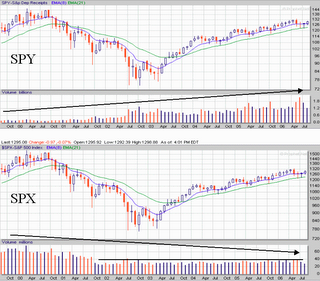

Note that voluem in the SPX began to decline towards the end of '02 about the same time that volume in SPY began to increase. The index volume then leveled off while the ETF volume began growing.

What can we say about that? Simple the ETF is gaining in popularity as an investment vehicle. But there are some subtleties you should notice. First the volume relationship from month to month remains consistent between the two charts. That is when one increases from one month to the next the other does as well.

Other things to notice - the highest volume month in the SPY just occurred in June. But the SPX had a higher volume point in May. One other point of comparison is the fact that while there was a tremendous amount of volume in June for both the index and the ETF they both printed a doji. In this instance I think that means that while the volume may be shown in red a tremendous amount of it was used to push both series up off the EMA 21. And indeed the second week in June was mostly pushing back from the 1220 line. You can look it up.

But regardless of the volume spikes which might or might not tell a story the most important thing to notice is just how consistent from month to month the volume remains. And that is my point. Volume is only part of the story and a very small part of it. The more important part of the story is price and how volatile it is.

I also find it extremely interesting to note how the ETF was used to buy the market out of its last depression. And that is the real tale of the volume - so far.

No comments:

Post a Comment