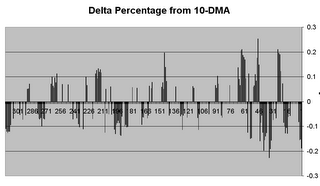

If I guess down every day I will be right quite frequently so I'm going to guess I don't know for Monday. Same tired tune - the VIX is massively below its 10 day average now (3 days past 10%) and while I have seen it go lower for a longer period - not much lower nor much longer. Here is the VIX from last June. You can see that the last 70 days or so have been extremely volatile (relative to its 10 day moving average) than any other time in the past year. I don't know what that means I just find it interesting and I'm sure we'll find out what it means eventually. Maybe, as with so many other indicators, absolutely nothing.

For purposes of illustration any plot less than +/- 5% is left off the chart. I'm not interested in anything but the extremes and approaching the extremes.

Meanwhile the Up/Down ratio sits at a benign 50%. This is a good sign as it suggest that a consolidation is taking place right under our noses and we aren't seeing it. That's because the new 20 day highs still sits at a massive 818 while the new 20 day lows sits at 182. Remember that 500+ in either direction is an overweight and requires some adjustment. Well the adjustment is taking place because today's reading is less than yesterdays. It doesn't have to be an abrupt change.

Then the DIA and the SPY both finished the last hour with a strong white candles and the Q's printed a doji. While many people consider a doji to be a reversal indicator (which it is many times) I consider it as a resting indicator and actually a continuation of the last candle. So that would make it a strong white too because the previous hour was strong white.

But we might have a gap down open on Monday (well it is Monday and what would Monday be without another gap down open - wait I know - Tuesday) and that is OK because many of my strongest plays have come from gap downs.

One thing I don't usually bother with is volume but the volume on Friday was very weak and that is a contrary indicator. It suggests that the shorts were all done covering on Thursday. Which makes sense because generally the third gap up open which is what happened Thursday scares the hell out of the shorts and they cover so there were no shorts left on Friday. So since the pro's all went to the beach at noon most of the buying Friday afternoon was retail trade and we know what that means - they're going to get crushed.

Well I'm flat and you can't crush money markets so even though I don't know what's going to happen on Monday I'm pretty sure of one thing - if I trade I'll make money.

More about that later.

No comments:

Post a Comment