Jim Cramer says that there is always a bull market somewhere and he will find it for you. Well you don't need Jim Cramer. Just go to stockcharts.com and set up a page called SPYDRs. On that page put the 9 ETFs known as SPYDRs. These are XLF - finance, XLK - tech, XLI - industrial, XLB - materials, XLE - energy, XLU - utilities, XLV - medical care, XLP - consumer staples, and, XLY - consumer discretionary. With those charts put some measure of overbought/oversold such as Slow Stochastics and watch the indicator. When everything but one or two are overbought attack those sectors that are oversold. This was XLE and XLU on a recent occassion (like for the past 4 weeks or so). You wait until one of the major indices such as OIH shows a turnaround and then move your assets to that sector.

If you do something like this you will always know where the bull market is coming next.

Thursday, September 28, 2006

Wednesday, September 27, 2006

Wednesday Wrapped

Took positions in VRSN and RHAT today. VRSN set up to look like it was going to break out and didn't. RHAT dropped 6 bucks off an "in line" report (isn't that the dumbest ass thing you ever heard of) and also started looking like it was going to hit the offer. Then the entire market levelled off and fell and bounced around a bit and I wound up with small losses on both of them.

All in all the moron's on CNBC will report a successful day - I say it was just crap. Of course there were several opportunities that I passed and that worked well but I already had my quota for the day.

Tomorrow is shaping up to be another dull day and that dullness will probably continue through Friday. I'm tired and I'm going to take the next couple of days off.

Anyway the three sisters all finished in the white today but the up/down ratio stays above 50% but not too bad - 52% - which is a neutral reading. The 20 day new highs pulled back but so did the 20 day new lows - a real barn burner of a day.

The VIX remains solidly in neutral. Coupled with the fact that this week is historically up and I believe both tomorrow and Friday will be bullish but not extremely so.

Stupid magic coin is 14 and 2 (nobody is that good - nobody) and for tomorrow it says - - - tails - bear a comin'. Could happen but I believe Friday will finish the month up strong. We won't know the magic coin's take since I only spin it once a day.

All in all the moron's on CNBC will report a successful day - I say it was just crap. Of course there were several opportunities that I passed and that worked well but I already had my quota for the day.

Tomorrow is shaping up to be another dull day and that dullness will probably continue through Friday. I'm tired and I'm going to take the next couple of days off.

Anyway the three sisters all finished in the white today but the up/down ratio stays above 50% but not too bad - 52% - which is a neutral reading. The 20 day new highs pulled back but so did the 20 day new lows - a real barn burner of a day.

The VIX remains solidly in neutral. Coupled with the fact that this week is historically up and I believe both tomorrow and Friday will be bullish but not extremely so.

Stupid magic coin is 14 and 2 (nobody is that good - nobody) and for tomorrow it says - - - tails - bear a comin'. Could happen but I believe Friday will finish the month up strong. We won't know the magic coin's take since I only spin it once a day.

Tuesday, September 26, 2006

Rap That Tuesday

Interesting day - started out strong collapsed under the weight, rolled over and went up. I played VRSN but entered too early so I didn't make as much as I could have had I waited. Tomorrow I'm waiting. If I don't make a play then I don't make a play but I am going to wait it out.

The interesting thing is this - when the three sisters go parabolic first thing out of the shute you generally expect them to roll back for awhile and that is what happened today. Nothing less nothing more. This is what it looks like. The third candle linked with the first two indicates a too strong opening. Then it looked like the price was going to retreat to EMA 8 but the open was so strong it went all the way to EMA 21. When it bounced off EMA 21 you could be pretty sure that it would go up the rest of the day.

We have mixed signals - the three sisters all finished strong white but that is a weak signal. The VIX remains neutral and that is a nothing signal. The up/down ratio retreated 2 percent today to .54 but the new 20 day highs extended by a hundred plus to 746 adn the new 20 day lows decreased to 237.

I think we are going up again tomorrow because I think the week of the month and quarter trumps everything else. The fund managers have an opportunity to make some points and they aren't going to pass the chance.

The magic coin is 13 and 2 having hit another homer with today's bullish behaviour and for tomorrow -o-o-o- heads again another bull day.

The interesting thing is this - when the three sisters go parabolic first thing out of the shute you generally expect them to roll back for awhile and that is what happened today. Nothing less nothing more. This is what it looks like. The third candle linked with the first two indicates a too strong opening. Then it looked like the price was going to retreat to EMA 8 but the open was so strong it went all the way to EMA 21. When it bounced off EMA 21 you could be pretty sure that it would go up the rest of the day.

We have mixed signals - the three sisters all finished strong white but that is a weak signal. The VIX remains neutral and that is a nothing signal. The up/down ratio retreated 2 percent today to .54 but the new 20 day highs extended by a hundred plus to 746 adn the new 20 day lows decreased to 237.

I think we are going up again tomorrow because I think the week of the month and quarter trumps everything else. The fund managers have an opportunity to make some points and they aren't going to pass the chance.

The magic coin is 13 and 2 having hit another homer with today's bullish behaviour and for tomorrow -o-o-o- heads again another bull day.

Monday, September 25, 2006

Wrapping Monday

As expected the market goes up. I made some on AMR and RIO but not as much as I could have because I was impatient to get the buy in and was well off the low of the day. Oh well - patience is one of my weaknesses and I really have to practice that more than anything else. This is the one weakness that kills most traders - impatience. Too quick to buy too quick to sell. It just takes discipline nothing more - most people don't have it and most people can acquire it.

Tomorrow should be a sideways kind of day - the up/down ratio is back up to 56% and the new 20 day highs are once again outpacing the new 20 day lows by 637 to 430 - still that's quite a few lows so I think sideways up could be expected. The VIX remains neutral but all of the sisters finished the last hour in the red. That is generally a weak sign. This week in September is generally pretty robust as the fund managers are looking to make some coin before the end of the quarter.

The magic coin is 12 and 2 having nailed today perfectly and for tomorrow says ... heads - again - another bull day.

Tomorrow should be a sideways kind of day - the up/down ratio is back up to 56% and the new 20 day highs are once again outpacing the new 20 day lows by 637 to 430 - still that's quite a few lows so I think sideways up could be expected. The VIX remains neutral but all of the sisters finished the last hour in the red. That is generally a weak sign. This week in September is generally pretty robust as the fund managers are looking to make some coin before the end of the quarter.

The magic coin is 12 and 2 having nailed today perfectly and for tomorrow says ... heads - again - another bull day.

Saturday, September 23, 2006

Volume Sometimes Leads to Funtimes

I'm not a great believer in volume because it is a meaningless component unless taken in such large quantities that everyone notices. But I do use volume as a filtering mechanism in that I want high volume stocks to ensure high liquidity (quick in quick out). I do believe in moving averages however and especially exponential moving averages. I think the EMA 90 is where the boys become men and I have made a lot of money doing what I call "riding the EMA 8" which is where a stock just goes up staying in close contact with the EMA 8.

Then I was doing some investigation of stocks that seemed to start going up and never coming down such as HANS and a couple of others and I saw one thing very quickly - in the monthly charts of such stocks there is a decided change in the volume several months after the first indications of rise occurs.

That means that institutions have taken notice of the stock and from here on out the original buyers are on easy street. There is no easier way to make money than to own a stock that funds must have.

This got me thinking - is there a possibility on a shorter term to get some action out of volume and the EMA 8? So I designed a filter -

show stocks where close is between 15 and 25

and close > ema(90)

and close 3 days ago < ema(8)

and close > ema(8)

and average volume(90) > 2500000

and average volume(15) > 4500000

and draw ema(21)

and draw ema(8)

All I'm asking for is a stock that is crossing over the 8-period EMA and who's volume in the past 15 days is about twice its normal (90 day average) volume.

I back tested this filter and came up with some interesting statistics - in the period from August 9th to Friday the 22nd of September the filter was right 69% of the time to 29% wrong on a 5 day basis. I will take a filter that gives me a 7 to 3 advantage over 5 days every day in the week.

To validate the filter I removed the line and average volume(15) > 4500000 and reran the test in the same period. I achieved 60% to 40% results. But the more interesting component is that with the original filter the ROI was 57% and with the modified filter it was 4%. That is an incredible difference and is of significance.

The filtering software I use is from stockfetcher.com and I get nothing from an indorsement so I suggest you try them out. The charts as in most instances come from prophet.net which I still consider to be an excellent site. Again no indorsement comps but go try them anyway. The annotations on the charts are done by me in power point - there are other, perhaps better packages but I am most familiar with good old power point.

Then I was doing some investigation of stocks that seemed to start going up and never coming down such as HANS and a couple of others and I saw one thing very quickly - in the monthly charts of such stocks there is a decided change in the volume several months after the first indications of rise occurs.

That means that institutions have taken notice of the stock and from here on out the original buyers are on easy street. There is no easier way to make money than to own a stock that funds must have.

This got me thinking - is there a possibility on a shorter term to get some action out of volume and the EMA 8? So I designed a filter -

show stocks where close is between 15 and 25

and close > ema(90)

and close 3 days ago < ema(8)

and close > ema(8)

and average volume(90) > 2500000

and average volume(15) > 4500000

and draw ema(21)

and draw ema(8)

All I'm asking for is a stock that is crossing over the 8-period EMA and who's volume in the past 15 days is about twice its normal (90 day average) volume.

I back tested this filter and came up with some interesting statistics - in the period from August 9th to Friday the 22nd of September the filter was right 69% of the time to 29% wrong on a 5 day basis. I will take a filter that gives me a 7 to 3 advantage over 5 days every day in the week.

To validate the filter I removed the line and average volume(15) > 4500000 and reran the test in the same period. I achieved 60% to 40% results. But the more interesting component is that with the original filter the ROI was 57% and with the modified filter it was 4%. That is an incredible difference and is of significance.

The filtering software I use is from stockfetcher.com and I get nothing from an indorsement so I suggest you try them out. The charts as in most instances come from prophet.net which I still consider to be an excellent site. Again no indorsement comps but go try them anyway. The annotations on the charts are done by me in power point - there are other, perhaps better packages but I am most familiar with good old power point.

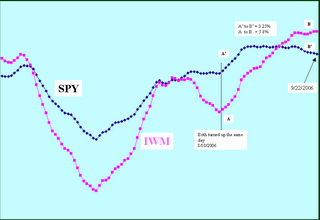

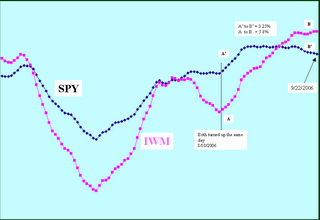

IWM Crosses SPY

The small cap index (represented by IWM) crossed over the large cap index (represented by SPY) about 10 days ago and I missed it. Actually it doesn't matter much to me who leads who but some people find it fascinating to talk about "Big Cap Big Cap Big Cap No Small Cap Small Cap Small Cap" and this,to me, is like arguing the merits of pink or yellow.

But what is interesting is how they both turned on the same day back in August but since then Small Cap has outperformed Big Cap. Small Cap, of course, has been the leader of this particular Bull Market and this is one thing that the tech worshippers and the Big Cap worshippers can't seem to grasp or understand - it is possible to have a bull market without either of those.

All the necessary information is on the slide. What you are looking at is my proprietary method of making sense out of nonsense called Marlyn's Curve - I've written about that somewhere in here and I'm not about to go find it.

But as always I save the best for last and here is a picture of the Q's with the IWM and the SPX and you can't help but notice that 1 - tech rolled over going up about 7 days before either of the other two and 2 - it has gone higher. In fact over the last 37 days tech has returned 9.2%.

During that period of time I have read numerous BLOGs bewailing the fact that tech is going nowhere, you can't have a market without tech, blah blah blah tech but the proof is in the picture (worth more than a 1000 blogs I might add). And the proof is that those dimbulbs really don't know what they are talking about - but you knew that because you always remember the sacred rule number 1.

One other thing you might care to notice - the Q's recently rolled over going down as has the SPX and the IWM. Be careful for the next couple of weeks or so. Marlyn's curve operates on about a 20 - 30 day cycle and it is suggesting a certain amount of weakness in the market as a whole.

But what is interesting is how they both turned on the same day back in August but since then Small Cap has outperformed Big Cap. Small Cap, of course, has been the leader of this particular Bull Market and this is one thing that the tech worshippers and the Big Cap worshippers can't seem to grasp or understand - it is possible to have a bull market without either of those.

All the necessary information is on the slide. What you are looking at is my proprietary method of making sense out of nonsense called Marlyn's Curve - I've written about that somewhere in here and I'm not about to go find it.

But as always I save the best for last and here is a picture of the Q's with the IWM and the SPX and you can't help but notice that 1 - tech rolled over going up about 7 days before either of the other two and 2 - it has gone higher. In fact over the last 37 days tech has returned 9.2%.

During that period of time I have read numerous BLOGs bewailing the fact that tech is going nowhere, you can't have a market without tech, blah blah blah tech but the proof is in the picture (worth more than a 1000 blogs I might add). And the proof is that those dimbulbs really don't know what they are talking about - but you knew that because you always remember the sacred rule number 1.

One other thing you might care to notice - the Q's recently rolled over going down as has the SPX and the IWM. Be careful for the next couple of weeks or so. Marlyn's curve operates on about a 20 - 30 day cycle and it is suggesting a certain amount of weakness in the market as a whole.

Friday, September 22, 2006

Friday and That's A Wrap

Made a bit on AMR this morning. Got on board using a method I call Two White Angels at 10:45 - 11:15 (see the chart and you'll see what that looks like). Got out 45 minutes later at the high of the day. That was pure luck - (high of day that is) - I wanted out at that time because I was done for the day.

I saw a couple of other potentials but when selecting between stocks I normally go with ones that I've played before.

The week ended just fine and met all expectations - i.e. a down week following expiry in September. Next week should be up if history is to be our guide.

Two of the three sisters finished the day in the last hour with white candles and the other one, the Q's, finished with a doji - although I'm not sure what it is resting from having done nothing all but go down.

The up/down ratio dropped some more to 31% and there are 549 new 20 day lows to 233 new 20 day highs. The VIX even went 5% over its 10 day average and all of these things together generally indicate an up day coming.

The magic coin is 11 and 2 having yet another winning day today and for Monday says ... heads - bull market.

I'll be back later this weekend with another filtering method that shows promise.

I saw a couple of other potentials but when selecting between stocks I normally go with ones that I've played before.

The week ended just fine and met all expectations - i.e. a down week following expiry in September. Next week should be up if history is to be our guide.

Two of the three sisters finished the day in the last hour with white candles and the other one, the Q's, finished with a doji - although I'm not sure what it is resting from having done nothing all but go down.

The up/down ratio dropped some more to 31% and there are 549 new 20 day lows to 233 new 20 day highs. The VIX even went 5% over its 10 day average and all of these things together generally indicate an up day coming.

The magic coin is 11 and 2 having yet another winning day today and for Monday says ... heads - bull market.

I'll be back later this weekend with another filtering method that shows promise.

Thursday, September 21, 2006

Wrap Me Thursday

What a crap day. Of course we predicted a down day yesterday and were expecting it but that isn't the reason for the glum - some analyst downgraded DTV before the open and I had to scramble to get a break-even. I bought at the bottom of the drop and because I averaged down I was able to sell at a break even price - don't ever do this. Once more I repeated my mantra - day trading means trade in the day not overnight.

I bought RIO and H and made some on both of them so the day wasn't a total loss - then I went and played golf.

Tomorrow we are up. The up/down ratio which is still proving to be the best "tell" is at 35%, the new 20 day highs printed 365 and the new lows 402 which is the first time the lows have outpaced the highs in awhile. The three sisters all finished with strong white candles and the VIX remains in neutral territory. These are all bullish indicators.

The magic coin nailed today and goes to 10 and 2 and for tomorrow says ... tails - bear market.

Well we disagree - we'll see.

I bought RIO and H and made some on both of them so the day wasn't a total loss - then I went and played golf.

Tomorrow we are up. The up/down ratio which is still proving to be the best "tell" is at 35%, the new 20 day highs printed 365 and the new lows 402 which is the first time the lows have outpaced the highs in awhile. The three sisters all finished with strong white candles and the VIX remains in neutral territory. These are all bullish indicators.

The magic coin nailed today and goes to 10 and 2 and for tomorrow says ... tails - bear market.

Well we disagree - we'll see.

Wednesday, September 20, 2006

Wednesday We Wrap

Read somewhere today that it "isn't a good time to buy stocks." I don't know - in my opinion - it is never a "good time to buy stocks" but it is always a good time to buy "stock".

There were a number of stocks that made substantial gains today. All of the indices increased and 7 out of the 9 spydrs also improved (energy and utilities being the exception).

Most of us (me especially) really suck at calling the bottoms but I'm pretty good at recognizing a stock that might go up a buck or so after it has bottomed and started back up.

I can't help but notice that the SPY is only 12 points away from its all time high and the DIA has been making new all time highs almost daily for months. Only the Q's are lagging but - who cares. During the past 30 months or so we have been in an obvious (but weak) bull market without tech so why can't it continue? Besides - who cares - ORCL posts a massive number yesterday gets a bump today and there it sits and will probably sit right there until its next earnings announcement. I.E. - who cares - tech stocks are commodities and servers and networks are a dime a dozen - literally. We've had bull markets without tech for years and years it will happen again.

During the run up in oil during the spring it was noted widely that the buying was mostly speculation and isn't what is happening what usually happens with speculation? A crash. Same thing is going on with gold and other precious metals.

I kind of figured that the game was over for both gold and oil when they didn't go parabolic after the most recent Iran/Iraq/Israil/ Hezbollah/al-Quada crisis.

So when is it a good time to buy stocks? Today was a good day but you had to play early. After 11 or so volatility dried up and even the expected Fed announcement couldn't shake things up. Still 4449 stocks finished above yesterday's close and that is 57% on the up/down ratio scale. 1039 made new 20 day highs which is 600 more than Tuesday and 371 made new 20 day lows which is 4 more than Tuesday.

The VIX moved back into warning territory (5% below 10 day MA) and the three sisters all finished with doji candlesticks. Doji as readers of this blog know (thanks Mom) are a resting indicator. But I think we should have a down day tomorrow and Friday.

The amazing magic coin is 9 and 2 because it was definitely a bull market today and for tomorrow the coin sees ... tails - bear market. We agree again.

I replaced my position in JBLU with one in DTV. I think it has a little run left from the one it began Friday. I'll probably hold this for a couple of days regardless of tomorrow's action and see what happens. Here's the chart - see if you can spot the bottom.

There were a number of stocks that made substantial gains today. All of the indices increased and 7 out of the 9 spydrs also improved (energy and utilities being the exception).

Most of us (me especially) really suck at calling the bottoms but I'm pretty good at recognizing a stock that might go up a buck or so after it has bottomed and started back up.

I can't help but notice that the SPY is only 12 points away from its all time high and the DIA has been making new all time highs almost daily for months. Only the Q's are lagging but - who cares. During the past 30 months or so we have been in an obvious (but weak) bull market without tech so why can't it continue? Besides - who cares - ORCL posts a massive number yesterday gets a bump today and there it sits and will probably sit right there until its next earnings announcement. I.E. - who cares - tech stocks are commodities and servers and networks are a dime a dozen - literally. We've had bull markets without tech for years and years it will happen again.

During the run up in oil during the spring it was noted widely that the buying was mostly speculation and isn't what is happening what usually happens with speculation? A crash. Same thing is going on with gold and other precious metals.

I kind of figured that the game was over for both gold and oil when they didn't go parabolic after the most recent Iran/Iraq/Israil/ Hezbollah/al-Quada crisis.

So when is it a good time to buy stocks? Today was a good day but you had to play early. After 11 or so volatility dried up and even the expected Fed announcement couldn't shake things up. Still 4449 stocks finished above yesterday's close and that is 57% on the up/down ratio scale. 1039 made new 20 day highs which is 600 more than Tuesday and 371 made new 20 day lows which is 4 more than Tuesday.

The VIX moved back into warning territory (5% below 10 day MA) and the three sisters all finished with doji candlesticks. Doji as readers of this blog know (thanks Mom) are a resting indicator. But I think we should have a down day tomorrow and Friday.

The amazing magic coin is 9 and 2 because it was definitely a bull market today and for tomorrow the coin sees ... tails - bear market. We agree again.

I replaced my position in JBLU with one in DTV. I think it has a little run left from the one it began Friday. I'll probably hold this for a couple of days regardless of tomorrow's action and see what happens. Here's the chart - see if you can spot the bottom.

Tuesday, September 19, 2006

Tuesday in a Wrap

I love it when a plan comes together. Actually I had some things to do this afternoon and I left about 12:30. In my absence JBLU went up. That was because oil came down - at least for most of the day. Oil (in the persona of XLE) now appears ready to go back up. Hopefully when the FED announces I'll be able to get out of JBLU with a substantial profit and those of you holding oil will also make some.

Tomorrow is looking like a good day - the three sisters all finished the last hour strong and the VIX is back in neutral territory as are the new 20 day high (453) and the new 20 day lows have increased significantly to 367. The up/down ratio which I feel is the best tell of all is at 36% and that suggests a big day a-comin'.

I'm not a perma-bull nor a bear - I'm just a trader and I play the market the same as my golf ball - as it lies.

The magic coin is now 8 and 2 since it predicted a bear market and every index went down today. For tomorrow ... bull.

This is no bull folks - I spin the coin once a day and where it lands is where it stays until the next spin tomorrow. We'll see.

Tomorrow is looking like a good day - the three sisters all finished the last hour strong and the VIX is back in neutral territory as are the new 20 day high (453) and the new 20 day lows have increased significantly to 367. The up/down ratio which I feel is the best tell of all is at 36% and that suggests a big day a-comin'.

I'm not a perma-bull nor a bear - I'm just a trader and I play the market the same as my golf ball - as it lies.

The magic coin is now 8 and 2 since it predicted a bear market and every index went down today. For tomorrow ... bull.

This is no bull folks - I spin the coin once a day and where it lands is where it stays until the next spin tomorrow. We'll see.

The Incredible 3 Candles

Actually it could be a couple more than three but generally three will suffice. I call this set-up "retreat to 8" in that the price is closing on the 8-period EMA.

How it works is simple - a gap up followed by a decline or sideways move towards the 8-period EMA. This culminates in a hammer or (hammer-like) object or narrow range object (as shown in the figure both the 3rd and 4th candles are narrow-range objects) and then with a touch of the EMA 8 (5th bar in the figure) the price takes off.

The color of the first bar can be either red or white as only the gap-up is required with a subsequent move back to the 8-period EMA.

I normally use the 15 or 30 minute charts in my trading but I have seen this set-up on just about every time frame including weekly. The arrow pattern to the right in the figure shows the method clearly.

How it works is simple - a gap up followed by a decline or sideways move towards the 8-period EMA. This culminates in a hammer or (hammer-like) object or narrow range object (as shown in the figure both the 3rd and 4th candles are narrow-range objects) and then with a touch of the EMA 8 (5th bar in the figure) the price takes off.

The color of the first bar can be either red or white as only the gap-up is required with a subsequent move back to the 8-period EMA.

I normally use the 15 or 30 minute charts in my trading but I have seen this set-up on just about every time frame including weekly. The arrow pattern to the right in the figure shows the method clearly.

Monday, September 18, 2006

Monday - It's a Wrap

IMO oil was a one day story - today and tomorrow we will be back to normal or what passes for normal these days. In addition, the Fed is going to pass on interest rates again this time around and lower a quarter right after the election to smooth the holidays for the retailers.

A pass on interest rates on Wednesday means a boom is coming so I hope you will be positioned to take advantage of it. The best position, of course, is out of the market and taking a nap when the announcement is made. I'm going to hold some JBLU through the announcement with the hopes that I'll catch a significant bounce. Actually I'm hoping that oil will retreat tomorrow and JBLU which moved about 20 cents today will move a half tomorrow in the right direction.

The VIX barely moved today and the three sisters finished the last hour painting white candles. The up/down ratio is 44% which is a little better and the new 20 day highs have returned to 641 from 873 on Friday. The new 20 day lows however also declined from Friday to 225. All of which is suspicious and again indicates that there just isn't much out there worth a bid. My guess a sideways market again tomorrow with some bullish inclination.

I'm going to give the magic coin today because he was almost right which makes him 7 and 2 and far better than your faithful correspondent. For tomorrow the coin says ... tails - bear market.

We'll see.

A pass on interest rates on Wednesday means a boom is coming so I hope you will be positioned to take advantage of it. The best position, of course, is out of the market and taking a nap when the announcement is made. I'm going to hold some JBLU through the announcement with the hopes that I'll catch a significant bounce. Actually I'm hoping that oil will retreat tomorrow and JBLU which moved about 20 cents today will move a half tomorrow in the right direction.

The VIX barely moved today and the three sisters finished the last hour painting white candles. The up/down ratio is 44% which is a little better and the new 20 day highs have returned to 641 from 873 on Friday. The new 20 day lows however also declined from Friday to 225. All of which is suspicious and again indicates that there just isn't much out there worth a bid. My guess a sideways market again tomorrow with some bullish inclination.

I'm going to give the magic coin today because he was almost right which makes him 7 and 2 and far better than your faithful correspondent. For tomorrow the coin says ... tails - bear market.

We'll see.

Saturday, September 16, 2006

Patience is a Rule not a Virtue

I am too impatient when I'm trading (among just about everything else) That is a fault that I have to work to overcome. I made three charts to put up on the wall of my trading station room so that they will always be in front of me. Some people such as myself need constant reminders until it takes effect. I chewed nicotine gum every day all day long everywhere I went for over 18 months until I finally was able to give up smoking. In that time I never took a cigarette, pipe, cigar or any other kind of tobacco but I chewed the gum. Today I am smoke free for over 5 years after being a nicotine slave for over 30. Anyway here are the "patience rules"

These are self-explanatory and you are welcome to copy them and use them for yourself.

These are self-explanatory and you are welcome to copy them and use them for yourself.

Oil Me Up

If I were a betting man I would bet that oil would be a good bet this next week. I am a believer in follow-through, or, if a stock is going up it should continue to go up until it doesn't and vice versa. I was just looking at the oil spyder XLE and it appears to me that it missed an opportunity on Friday to go down. In fact it showed how tired it was of the trend with a doji. While the doji is not necessarily a bottom indicator if XLE goes above 52.50 on Monday I'd say it was a good bet to take another run.

This was also confirmed by the OIH (oil holders ETF) on Friday. Again an opportunity to go down and instead it went up and is showing a consolidation. 126.50 on Monday would be an indicator that it might be coming back.

Charts from stockcharts.com - an excellent site.

This was also confirmed by the OIH (oil holders ETF) on Friday. Again an opportunity to go down and instead it went up and is showing a consolidation. 126.50 on Monday would be an indicator that it might be coming back.

Charts from stockcharts.com - an excellent site.

Friday Wrap-Up

Late - as usual - had some things to do - sorry.

Played AMR right out of the gate and made a nice, easy, quick score. Then replayed it later and made a nice, slow, painful loss. Even for the day but had I quit in the early going with my profit I would have been just fine. I'm developing a set of "patience" rules. I'll share them later this weekend.

An awful day all told and not just because of the loss. I have to remember not to play expiration Friday. It truly is a low volatile crappy day all around. The SPY actually tells the story with greatest clarity - where the DIA and Q's both gapped open and stayed up most of the day the SPY opened up and immediately closed below the previous day's close. For all three sisters it was a roller coaster from there but mostly sideways down. All three ended the last hour in the red. Here's how the SPY looked on the 4-minutes - the others had a similar pattern.

The up/down ratio stands at 50% which suggests that some stocks caught a bid off of Thursday's performance and the new 20 day high vs low prints 873 to 332 or not much change. The VIX continues to recede towards its 10-day average however which suggests that the fear is leaving the market regardless of the internals.

They say (the ubiquitous "They") that the week after September expiration is generally a downer. In 4 of the last 5 years "they" were correct. Who am I to say "they" are dumber that the dumbest dog on the darkest night? Nobody that's who. So let's "go with the flow" and see what happens. I think we are in for a small correction. We'll see.

The magic coin is 6 for 2 (I'll give him Friday even though it was so flat) and for Monday he says ... heads - bull market coming.

Played AMR right out of the gate and made a nice, easy, quick score. Then replayed it later and made a nice, slow, painful loss. Even for the day but had I quit in the early going with my profit I would have been just fine. I'm developing a set of "patience" rules. I'll share them later this weekend.

An awful day all told and not just because of the loss. I have to remember not to play expiration Friday. It truly is a low volatile crappy day all around. The SPY actually tells the story with greatest clarity - where the DIA and Q's both gapped open and stayed up most of the day the SPY opened up and immediately closed below the previous day's close. For all three sisters it was a roller coaster from there but mostly sideways down. All three ended the last hour in the red. Here's how the SPY looked on the 4-minutes - the others had a similar pattern.

The up/down ratio stands at 50% which suggests that some stocks caught a bid off of Thursday's performance and the new 20 day high vs low prints 873 to 332 or not much change. The VIX continues to recede towards its 10-day average however which suggests that the fear is leaving the market regardless of the internals.

They say (the ubiquitous "They") that the week after September expiration is generally a downer. In 4 of the last 5 years "they" were correct. Who am I to say "they" are dumber that the dumbest dog on the darkest night? Nobody that's who. So let's "go with the flow" and see what happens. I think we are in for a small correction. We'll see.

The magic coin is 6 for 2 (I'll give him Friday even though it was so flat) and for Monday he says ... heads - bull market coming.

Friday, September 15, 2006

Stop Crying

In the past month somebody (not me) made a ton of cash selling oil, nat gas, and metals to the retail trade (let's hope it wasn't the all knowing fund managers coming late to the party). That means that a lot of cash is out there to be put back to work - where else except a rotation into (select) tech?

While tech is going up it isn't booming nor is it universal. But when little crap companines such as FNSR start catching a bid you know something is up. When ORCL starts burning you really know something is up.

The airplane patch is also catching a some bids - I'm making my year from stocks like AMR. This is probably because oil is going down - but I don't care why. All I know is that the charts say - "buy me".

Now I could sit around and ask "whyyyyyy" or I can take a few bucks and make a few bucks. And since that's what I do - that's what I'm doing.

I've lost a small fortune trying to predict the bottom in anything and outguessing the market - I've made a small fortune just going with the flow. There's a river of money running through this box (computer) in front of me and everyday I reach in and try to catch a couple of Benjamins. I'm not bothered with the "why" part of it anymore.

And though I may turn the air blue with a stream of invective every now and again - I never cry.

While tech is going up it isn't booming nor is it universal. But when little crap companines such as FNSR start catching a bid you know something is up. When ORCL starts burning you really know something is up.

The airplane patch is also catching a some bids - I'm making my year from stocks like AMR. This is probably because oil is going down - but I don't care why. All I know is that the charts say - "buy me".

Now I could sit around and ask "whyyyyyy" or I can take a few bucks and make a few bucks. And since that's what I do - that's what I'm doing.

I've lost a small fortune trying to predict the bottom in anything and outguessing the market - I've made a small fortune just going with the flow. There's a river of money running through this box (computer) in front of me and everyday I reach in and try to catch a couple of Benjamins. I'm not bothered with the "why" part of it anymore.

And though I may turn the air blue with a stream of invective every now and again - I never cry.

Thursday, September 14, 2006

Thursday Wrap

AMR again. Another nice profit - not as good as Tuesday but at least half. Not enough to make me take another day off so I'll be back in the mines again tomorrow.

As for tomorrow I think it should go up. Options expiration day be damned. The up/down ratio (which is proving to be the best tell of all) prints 37% and the new 20 day highs vs lows shows 640 to 323. The VIX is coming back from being way oversold or overbought (I never get that right) and all three sisters printed white candles in the last hour. In fact if it weren't for that they would have all finished down for the day. The volume is still weak however and that is not a good sign. But the evidence points to an up day - maybe not a strong day but an up day.

The magic coin called the day and even though the three sisters were only up a few cents it still was a bull market. He sits at 5 and 2 which is far better than I am doing over the same period and for tomorrow he says ... heads - bull market.

Still working on the 2 hour method - I'll get back to you as soon as I have something positive (or negative) to say.

As for tomorrow I think it should go up. Options expiration day be damned. The up/down ratio (which is proving to be the best tell of all) prints 37% and the new 20 day highs vs lows shows 640 to 323. The VIX is coming back from being way oversold or overbought (I never get that right) and all three sisters printed white candles in the last hour. In fact if it weren't for that they would have all finished down for the day. The volume is still weak however and that is not a good sign. But the evidence points to an up day - maybe not a strong day but an up day.

The magic coin called the day and even though the three sisters were only up a few cents it still was a bull market. He sits at 5 and 2 which is far better than I am doing over the same period and for tomorrow he says ... heads - bull market.

Still working on the 2 hour method - I'll get back to you as soon as I have something positive (or negative) to say.

Wednesday, September 13, 2006

Wednesday Wrap-Up

My tradition is to take a day off after a big win. That is because I have found that I can piss away a profit faster than I can earn it. By taking a day off the desire to trade recklessly subsides and I can approach the market in a calmer manner again. Today was a day off.

It was a weak day even though the averages were up strong. Tomorrow should be moderate to down and Friday should be dead even because this is, after all, expiration week. The up/down ratio sits at 56% - down a bit from yesterday and the new high/lows printed 1137 to 139. Once again we are in a position where we need a couple of down days just to find something to buy on the bull side. The VIX continues to decline and sits at 12% below its 10 day moving average which is always a cautionary moment. Two of the three sisters finished the day in the white (Q's and SPY) but neither one of them showed much strength.

The magic coin is 4 and 2 and for tomorrow it says ... heads - bull market coming.

It was a weak day even though the averages were up strong. Tomorrow should be moderate to down and Friday should be dead even because this is, after all, expiration week. The up/down ratio sits at 56% - down a bit from yesterday and the new high/lows printed 1137 to 139. Once again we are in a position where we need a couple of down days just to find something to buy on the bull side. The VIX continues to decline and sits at 12% below its 10 day moving average which is always a cautionary moment. Two of the three sisters finished the day in the white (Q's and SPY) but neither one of them showed much strength.

The magic coin is 4 and 2 and for tomorrow it says ... heads - bull market coming.

One-Way Directed People

I don't rant often but I just ran across a web site written by a prolific writer who seems to have a (wrong-headed) opinion about everything. Maybe not wrong headed but definitely one-way directed. As they say even a broken watch has the correct time twice a day - so it is with this guy - every once in awhile he is probably correct in his one-way of looking at things.

I wondered WTF until I noticed that he hailed from Kansas and all of a sudden things became crystal clear - Kansas - OK - what else comes from Kansas - hot air and bull snot - and that explains a lot of things.

Kiddies - remember rule 1 - nobody knows nothing - including me. So be careful out there - this guy makes his living as a financial advisor and I wouldn't take his advice about anything including what toilet paper to buy or what color to make my place mats. He is - in short - a dumb ass as are all one-way directed people especially those from Kansas.

I wondered WTF until I noticed that he hailed from Kansas and all of a sudden things became crystal clear - Kansas - OK - what else comes from Kansas - hot air and bull snot - and that explains a lot of things.

Kiddies - remember rule 1 - nobody knows nothing - including me. So be careful out there - this guy makes his living as a financial advisor and I wouldn't take his advice about anything including what toilet paper to buy or what color to make my place mats. He is - in short - a dumb ass as are all one-way directed people especially those from Kansas.

Tuesday, September 12, 2006

Tuesday Wrap

Nice ride today. I had AMR and made a serious amount of money from it. But just about anything except oil and metals was good today. I like days that require no skill just courage.

Tomorrow is shaping up to be a bit of a down day. The up/down ratio sits at 65% and there are 1194 new 20 day highs to 326 new 20 day lows. The VIX is in fear territory again and the sisters closed with red candles. If it doesn't go down I wouldn't be surprised if it went sideways.

The magic coin is 4 and 1 having called for a bull market today. For tomorrow ... tails - bear market.

We'll see. I'll have another installment of the 2-hour charts later or tomorrow morning.

Tomorrow is shaping up to be a bit of a down day. The up/down ratio sits at 65% and there are 1194 new 20 day highs to 326 new 20 day lows. The VIX is in fear territory again and the sisters closed with red candles. If it doesn't go down I wouldn't be surprised if it went sideways.

The magic coin is 4 and 1 having called for a bull market today. For tomorrow ... tails - bear market.

We'll see. I'll have another installment of the 2-hour charts later or tomorrow morning.

2 Hours to Profits

Well that's a bit of a stretch but if it got your attention then it's a successful headline. My reader, hi Mom, liked it so what do I care if you do or not. Anyway, as promised, here is the first chapter of using the 2-hour charts to develop trades.

The 2-hour charts provide a wealth of trading opportunities. Once you get a positive signal you can almost trade with carefree abandon - although I don’t care to even think about that because it hurts my head. Let’s review the bidding.

1. A Doji star suggests a bottom. The next day a hammer is printed in the 1 - 2 P.M. time frame. A purchase here at $24.00 can be held (overnight) for a $1 gain.

2. A Doji star suggests a bottom. The next day gaps up and the purchase can be made after the first 30 minutes or so at about 25.20. Sell again after $1 gain at the end of the day.

3. A gap down that immediately starts going up following four red candles of the previous day. A buy at $24.00 (again) can be sold at the red hammer end of day indicator of $24.60.

4. The previous day’s red hammer end suggests a wait and see but the next day starts out with a gap up, a brief pull back and then a follow through to the end of day. A purchase around $25.00 could be sold at $25.80 for a nice profit.

The 2-hour charts provide opportunities but you have to be patient and only take the trades that make sense. The reason that the 2-hour charts make sense is that once the trade develops it continues to run long enough to make a profit from it. Generally speaking we want to take the trade off a signal from the previous day’s close. A Doji or red hammer or even a white hammer below the EMA 8 is enough to keep us interested. In the third case (3) we will try to take the next day's start off the four red candles of the previous day.

Note that this time we didn't have any short sales, that's because in this example we didn't have any absolute top indicators. In future posts regarding this topic I'll show some shorts.

Needless to say (but I will anyway) this is just a set of suggestions - you must practice first before you use any of these ideas to try to make some money. But the 2-hour chart method is looking promising.

The 2-hour charts provide a wealth of trading opportunities. Once you get a positive signal you can almost trade with carefree abandon - although I don’t care to even think about that because it hurts my head. Let’s review the bidding.

1. A Doji star suggests a bottom. The next day a hammer is printed in the 1 - 2 P.M. time frame. A purchase here at $24.00 can be held (overnight) for a $1 gain.

2. A Doji star suggests a bottom. The next day gaps up and the purchase can be made after the first 30 minutes or so at about 25.20. Sell again after $1 gain at the end of the day.

3. A gap down that immediately starts going up following four red candles of the previous day. A buy at $24.00 (again) can be sold at the red hammer end of day indicator of $24.60.

4. The previous day’s red hammer end suggests a wait and see but the next day starts out with a gap up, a brief pull back and then a follow through to the end of day. A purchase around $25.00 could be sold at $25.80 for a nice profit.

The 2-hour charts provide opportunities but you have to be patient and only take the trades that make sense. The reason that the 2-hour charts make sense is that once the trade develops it continues to run long enough to make a profit from it. Generally speaking we want to take the trade off a signal from the previous day’s close. A Doji or red hammer or even a white hammer below the EMA 8 is enough to keep us interested. In the third case (3) we will try to take the next day's start off the four red candles of the previous day.

Note that this time we didn't have any short sales, that's because in this example we didn't have any absolute top indicators. In future posts regarding this topic I'll show some shorts.

Needless to say (but I will anyway) this is just a set of suggestions - you must practice first before you use any of these ideas to try to make some money. But the 2-hour chart method is looking promising.

Monday, September 11, 2006

Monday Wrap-up

Made five trades today and made money on all of them. Took positions on ALTR, ATHR, CHKP, DHI,and SYMC. Maybe I have my mojo back. But and this is a big but - five trades are three too many so I have to watch my step.

Tomorrow should be an up day. The up/down ratio sits at 38% there are 655 new 20 day lows vs 486 new 20 day highs, the VIX is way back in neutral territory (+/- 5%) and the three sisters all finished with white candles. All of that spells an up market.

The magic coin is now 3 and 1, it called for a down market today and missed. For tomorrow the coin says ... heads - bull market.

We'll see.

Anyway I've been doing some research on the 2-hour charts and I think I might have some good information there. If it pans out I'll do a posting later tonight or tomorrow with my preliminary findings.

Tomorrow should be an up day. The up/down ratio sits at 38% there are 655 new 20 day lows vs 486 new 20 day highs, the VIX is way back in neutral territory (+/- 5%) and the three sisters all finished with white candles. All of that spells an up market.

The magic coin is now 3 and 1, it called for a down market today and missed. For tomorrow the coin says ... heads - bull market.

We'll see.

Anyway I've been doing some research on the 2-hour charts and I think I might have some good information there. If it pans out I'll do a posting later tonight or tomorrow with my preliminary findings.

Sunday, September 10, 2006

Back From Vacation

Looks like I didn't miss much. Thursday's volume picked up a bit and the market slid a bit. Friday's volume returned to what has become normal of late (anemic) but the market went up a bit. But I think we are going up Monday - there just isn't much more that can be sold because there are going to be a lot of buyers.

The stats are simple enough - the three sisters all closed with red candles but they all finished the 2-hour charts on Thursday well below the 20 EMA.

The up/down ratio is about 53% which is a strong turnaround from Wednesday and Thursday and the 20 day high vs 20 day low stands at 425 to 421. The VIX is below 5% away from its 10 day average. All of this is suggesting a short term bottom is forming or has formed so I'm looking for an up day Monday.

The magic coin is now 3 and 0 (to my 0 and 3) and for Monday it says ... tails - bear market.

The stats are simple enough - the three sisters all closed with red candles but they all finished the 2-hour charts on Thursday well below the 20 EMA.

The up/down ratio is about 53% which is a strong turnaround from Wednesday and Thursday and the 20 day high vs 20 day low stands at 425 to 421. The VIX is below 5% away from its 10 day average. All of this is suggesting a short term bottom is forming or has formed so I'm looking for an up day Monday.

The magic coin is now 3 and 0 (to my 0 and 3) and for Monday it says ... tails - bear market.

Wednesday, September 06, 2006

Wednesday Wrap Up

I managed to get out of RBAK this morning just ahead of disaster and then, 45 minutes into the day, put another trade on and lost what I made from yesterday. That was just pure stupidity nothing else to say about it. Didn't even have a good set up just didn't believe it could fall that far that fast without a bounce. It didn't bounce for another 2 bucks. I was out long before that but good grief what a maroon!

I won't be in for the rest of the week but based on my reading of the tea leaves it looks like tomorrow will bring a turnaround. Up/Down ratio sits at 21%, and new 20 day high vs low shows 251 to 356. The VIX, while not completely, is nearly 10% higher than its 10-day average.

The three sisters are showing an interesting formation - in the last two hours of the day a white candle or doji below the 21-period EMA. This is proving to be a winner in single stocks as well and I plan to expand on it in the near future for your edification.

Hope you are positioned for it. So let the record show that I'm expecting a bull market tomorrow.

The magic coin is now 2 and 0 and for tomorrow - tails - a bear market. OK - we'll see.

And we'll see you all again on Monday.

I won't be in for the rest of the week but based on my reading of the tea leaves it looks like tomorrow will bring a turnaround. Up/Down ratio sits at 21%, and new 20 day high vs low shows 251 to 356. The VIX, while not completely, is nearly 10% higher than its 10-day average.

The three sisters are showing an interesting formation - in the last two hours of the day a white candle or doji below the 21-period EMA. This is proving to be a winner in single stocks as well and I plan to expand on it in the near future for your edification.

Hope you are positioned for it. So let the record show that I'm expecting a bull market tomorrow.

The magic coin is now 2 and 0 and for tomorrow - tails - a bear market. OK - we'll see.

And we'll see you all again on Monday.

Targets for a Wednesday

I'm not sure if this is valuable or not but I'll be watching FNSR, RBAK, RHAT, ACI and INTC today. Will let you know later how these turned out.

Trading Rules

The trading rules are different from the life rules. In the life rules the primary rule is nobody knows nothing - or, to say it another way, trust - but verify, or, to say it another way, if you are in a poker game and you don't know who the dumbass is - it's you. But that's life.

The trading rules on the other hand are far less philosophical. Rule 1 - nobody knows nothing especially you. Rule 2 - every day is a new day with a new start complete with a new opportunity to succeed or otherwise comport yourself. Rule 3 - patience is not only a virtue it is the best money saving method ever devised.

If you understand rule 1 you might even have a chance of suceeding in this game. The reason for that is if you adhere to rule 1 you won't become an arrogant jerk and lose all of your trading funds on a few plays. It took me two tries to discover rule 1 - but I'm slow. I'm still an arrogant jerk which is why rule 2 is necessary but rule 1 reminds me that I don't know anything and I need to learn again with each and every trade.

Rule 2 suggests that there is an opposite to success and that is the most important part of rule 2. That is why rule 2 is written in a way guaranteed to challenge even the most erudite scholar. Rule 2 makes your head hurt - bad trades make your head hurt - rule 2 is a winner. The opportunity that every day presents is to succeed or to fail. Measure your successes one day at a time and measure your failures in the same way.

In the game of golf which is very close to the game of life there is one cardinal rule - never follow a bad shot with a bad shot. Even if it means taking a slam dunk, can't miss baby chip - do it because it will put you back on the road to success and that's where you want to be. In trading you should attempt to never follow a bad trade with a bad trade. But there are no slam dunk trades or are there? In an upward going market there are a lot of stocks that will go up a dime or twenty cents in a very little while. In this day and age of small commissions you should be able to take a successful, break-even trade fairly quickly. Take it, savor the win, and press on. Repeat after me - a profit is better than a loss - any profit - any loss.

Rule 3 was written to supplement rule 2 - rule 3 says that sometimes the best thing to do is to wait. If you don't know how to wait then the first thing you should practice is waiting. If you are impatient you will rush into trades that may prove disasterous. I trade from home. The market opens at 9:30. If I have an overnight trade I wait until the market opens and then make my trade within the first five minutes or so. Then I close my trading station and do something else for the next 30 minutes or so. Most days I shower and shave. I have learned (the painful way) that I have no business trading in the first half hour of the day. Some people make money trading the 2-minute boundaries. Most people trade better on the 15-minute charts and even more people trade best on the 30-minute charts. Patience is not just a virtue it is the key to winning.

There are no other rules that will serve you as well as these. You're welcome.

The trading rules on the other hand are far less philosophical. Rule 1 - nobody knows nothing especially you. Rule 2 - every day is a new day with a new start complete with a new opportunity to succeed or otherwise comport yourself. Rule 3 - patience is not only a virtue it is the best money saving method ever devised.

If you understand rule 1 you might even have a chance of suceeding in this game. The reason for that is if you adhere to rule 1 you won't become an arrogant jerk and lose all of your trading funds on a few plays. It took me two tries to discover rule 1 - but I'm slow. I'm still an arrogant jerk which is why rule 2 is necessary but rule 1 reminds me that I don't know anything and I need to learn again with each and every trade.

Rule 2 suggests that there is an opposite to success and that is the most important part of rule 2. That is why rule 2 is written in a way guaranteed to challenge even the most erudite scholar. Rule 2 makes your head hurt - bad trades make your head hurt - rule 2 is a winner. The opportunity that every day presents is to succeed or to fail. Measure your successes one day at a time and measure your failures in the same way.

In the game of golf which is very close to the game of life there is one cardinal rule - never follow a bad shot with a bad shot. Even if it means taking a slam dunk, can't miss baby chip - do it because it will put you back on the road to success and that's where you want to be. In trading you should attempt to never follow a bad trade with a bad trade. But there are no slam dunk trades or are there? In an upward going market there are a lot of stocks that will go up a dime or twenty cents in a very little while. In this day and age of small commissions you should be able to take a successful, break-even trade fairly quickly. Take it, savor the win, and press on. Repeat after me - a profit is better than a loss - any profit - any loss.

Rule 3 was written to supplement rule 2 - rule 3 says that sometimes the best thing to do is to wait. If you don't know how to wait then the first thing you should practice is waiting. If you are impatient you will rush into trades that may prove disasterous. I trade from home. The market opens at 9:30. If I have an overnight trade I wait until the market opens and then make my trade within the first five minutes or so. Then I close my trading station and do something else for the next 30 minutes or so. Most days I shower and shave. I have learned (the painful way) that I have no business trading in the first half hour of the day. Some people make money trading the 2-minute boundaries. Most people trade better on the 15-minute charts and even more people trade best on the 30-minute charts. Patience is not just a virtue it is the key to winning.

There are no other rules that will serve you as well as these. You're welcome.

Tuesday, September 05, 2006

Tuesday

Not bad - I took positions in BRCM, BEAS, NOK and RBAK and made some money in all of them. NOK and RBAK I took after noon in the second wave. I sold out NOK at the close and held RBAK overnight. I think it will bounce in the morning and I'm going to grab a few more cents if it does.

Tomorrow should be interesting - QQQQ and DIA both finished with last hour white candles and SPX finished with a Doji. The VIX remains neutral and the up/down ratio sits at 53% up and 52% up on the 10 day average. The new 20 day highs vs lows printes 1222 to 103. 1222 is getting up there in the stratosphere. If I were to guess I'd say tomorrow is more of the same like today.

The coin flip is now 1 and 0 correct. For tomorrow the magic coin says - tails - bearish.

Tomorrow should be interesting - QQQQ and DIA both finished with last hour white candles and SPX finished with a Doji. The VIX remains neutral and the up/down ratio sits at 53% up and 52% up on the 10 day average. The new 20 day highs vs lows printes 1222 to 103. 1222 is getting up there in the stratosphere. If I were to guess I'd say tomorrow is more of the same like today.

The coin flip is now 1 and 0 correct. For tomorrow the magic coin says - tails - bearish.

More Bear Talk

My reader wanted to know if the market was going to go down this Fall.

Yes, Mom, someday the market is going to go down. Sooner or later it will get tired and the tide will roll out. But here is an annotated chart (from StockCharts.com – a great site) that shows all of the “top” calls of the past three years. And, trust me, only a handful of those “expert opinions” have been put on the map.

Obviously the top was called in an extremely scientific and precise manner.

So the next time you hear or read about “head and shoulders” and determine that they are not talking about a shampoo – run for your life. Same with “twin tops”, RSI oversold, MACD divergence, falling on high volume and Tweezer tops. There is no doubt one or more of these gurus will “call the top” and henceforth make his or her reputation. But let's face it - when you call for a cyclical event to occur every other month or so (complete with annotated charts) – you are bound to get lucky every once in awhile.

Yes, Mom, someday the market is going to go down. Sooner or later it will get tired and the tide will roll out. But here is an annotated chart (from StockCharts.com – a great site) that shows all of the “top” calls of the past three years. And, trust me, only a handful of those “expert opinions” have been put on the map.

Obviously the top was called in an extremely scientific and precise manner.

So the next time you hear or read about “head and shoulders” and determine that they are not talking about a shampoo – run for your life. Same with “twin tops”, RSI oversold, MACD divergence, falling on high volume and Tweezer tops. There is no doubt one or more of these gurus will “call the top” and henceforth make his or her reputation. But let's face it - when you call for a cyclical event to occur every other month or so (complete with annotated charts) – you are bound to get lucky every once in awhile.

Sunday, September 03, 2006

Buy the Dips Sell the Rips

Just for fun I back-tested two filters against two separate date ranges - one range where I knew that the market went up and one where I knew that the market went down. The two periods were July 17 through July 28 and June 2 through June 14 respectively. The reason why the periods are unequal in length is that the down period is contiguously down i.e. every day closed lower than the day before while the up period had two down closes in it. So by lengthening the up period to include eight up closes I think they are roughly equal.

The filters were simple – close between 15 and 50, average 90 day volume greater than 500000 and for one – the close was more than 75 cents greater than the open and for the other - the close was more than 75 cents lower than the open. That is – the two filters were exactly opposite in nature on a single day.

The results will amaze and astound you – or maybe not but pay attention anyway. For the up-going period the 75-cent gainer found 150 completed trades. Of these 54% resulted in a net gain. The annualized return on investment (ROI) was –14.81%. That is while the filter found more winners than losers overall it lost money. On the other hand the 75-cent loser found 102 completed trades. Of these 57% resulted in a net gain and the ROI was plus 55%. This proves that in an up going market buying the dips is more profitable than following the money.

But - what about a down going market? Glad you asked.

The 75-cent gainers found 65 completed trades that resulted in a 28% net gain and an ROI of –355%. The 75-cent losers found 100 completed trades that resulted in a 16% net gain and an ROI of –450%. So in a down going market the gainers do better than the losers but both come out to be large losers.

But I dislike ROI as an indicator I prefer the dollar results and here they are.

75-cent gainers up market: -$2.16 (-14.81% ROI)

75-cent gainers down market: -$60.23 (-355%)

75-cent losers up market: $20.77 (55%)

75-cent losers down market: -$178.07 (-450%)

Pretty conclusive stuff – the best long trades from start to finish are the dippers in an upward moving market. The best shorts are the dippers in the downward moving markets.

So it isn't "buy the dips sell the rips" but rather "buy the dips and sell the dips".

The filters were simple – close between 15 and 50, average 90 day volume greater than 500000 and for one – the close was more than 75 cents greater than the open and for the other - the close was more than 75 cents lower than the open. That is – the two filters were exactly opposite in nature on a single day.

The results will amaze and astound you – or maybe not but pay attention anyway. For the up-going period the 75-cent gainer found 150 completed trades. Of these 54% resulted in a net gain. The annualized return on investment (ROI) was –14.81%. That is while the filter found more winners than losers overall it lost money. On the other hand the 75-cent loser found 102 completed trades. Of these 57% resulted in a net gain and the ROI was plus 55%. This proves that in an up going market buying the dips is more profitable than following the money.

But - what about a down going market? Glad you asked.

The 75-cent gainers found 65 completed trades that resulted in a 28% net gain and an ROI of –355%. The 75-cent losers found 100 completed trades that resulted in a 16% net gain and an ROI of –450%. So in a down going market the gainers do better than the losers but both come out to be large losers.

But I dislike ROI as an indicator I prefer the dollar results and here they are.

75-cent gainers up market: -$2.16 (-14.81% ROI)

75-cent gainers down market: -$60.23 (-355%)

75-cent losers up market: $20.77 (55%)

75-cent losers down market: -$178.07 (-450%)

Pretty conclusive stuff – the best long trades from start to finish are the dippers in an upward moving market. The best shorts are the dippers in the downward moving markets.

So it isn't "buy the dips sell the rips" but rather "buy the dips and sell the dips".

Saturday, September 02, 2006

Friday

I'm a little late but was busy yesterday. Let's get the targets out of the way first - three up and two down. That is turning out to be a useless piece of information and I'm going to discontinue it. I took a trade in CHKP that I closed for a small profit because I wanted to be flat at noon and I was. I also had OVTI that made a bit more and actually made my target for the day by noon.

There was an interesting piece of historical data that suggested that every day-before- Labor Day weekend would be bullish in nature and Friday was no exception. We'll have to remember that for next year - can hardly wait.

I, as usual, was wrong about direction again and I am hoping that you remember rule 1 - nobody knows nothing including me. I'll keep making my case for the next day but my batting average is mighty poor and I might as well just guess. So here is what I'm gong to do. I'm going to present my "science" and my "prediction" then I'm going to flip a coin and if it's heads I'm calling the next day as up and if tails then it will be down.

First the science - the three sisters are all red which suggests a down day the next day but has not worked lately. In fact it hasn't worked 9 out of the last 10 days - in fact it seems to be a contrary indicator. I.e. last hour down - next day closes up - we'll watch this for awhile.

The Up/down ratio is 55% which suggests a weak Tuesday (note the careful choice of weasel words - weak). The VIX remains neutral which is perfect for what has been happening and the new 20 day high/low numbers are 1058 to 106. Still not a whole bunch out there to buy at least not with much confidence for a day trader.

Coin flip says - Heads! Going to be a bull's day on Tuesday.

We'll see.

There was an interesting piece of historical data that suggested that every day-before- Labor Day weekend would be bullish in nature and Friday was no exception. We'll have to remember that for next year - can hardly wait.

I, as usual, was wrong about direction again and I am hoping that you remember rule 1 - nobody knows nothing including me. I'll keep making my case for the next day but my batting average is mighty poor and I might as well just guess. So here is what I'm gong to do. I'm going to present my "science" and my "prediction" then I'm going to flip a coin and if it's heads I'm calling the next day as up and if tails then it will be down.

First the science - the three sisters are all red which suggests a down day the next day but has not worked lately. In fact it hasn't worked 9 out of the last 10 days - in fact it seems to be a contrary indicator. I.e. last hour down - next day closes up - we'll watch this for awhile.

The Up/down ratio is 55% which suggests a weak Tuesday (note the careful choice of weasel words - weak). The VIX remains neutral which is perfect for what has been happening and the new 20 day high/low numbers are 1058 to 106. Still not a whole bunch out there to buy at least not with much confidence for a day trader.

Coin flip says - Heads! Going to be a bull's day on Tuesday.

We'll see.

Friday, September 01, 2006

Friday's Targets

There are always targets even in a market that is resting. Today I will be watching NZT, JNPR, KR, SGP and CHKP. All came up on my screen as having a momentum follow-through potential.

Just remember that the day will be over by noon.

Just remember that the day will be over by noon.

Subscribe to:

Comments (Atom)